Announcing the infineo Policy Ledger

Picture this: A man in his late 70s has a sudden medical event and is rushed to the hospital. The hospital contacts his three children, who all live out of state, and they drop everything to rush to their father’s bedside. Fortunately they (and the grandkids) make it in time to say goodbye, and afterward they discuss how, “Dad has never been the same since Mom left us two years ago.”

Now as the kids are making the funeral preparations and winding down their father’s financial affairs, they can’t find any records of a life insurance policy. Their parents had always been very responsible and the children assume they must have had coverage, but nothing is jumping out from their father’s file cabinet or safe deposit box at the bank. What should have given them peace of mind in this difficult time is turning into yet another hassle.

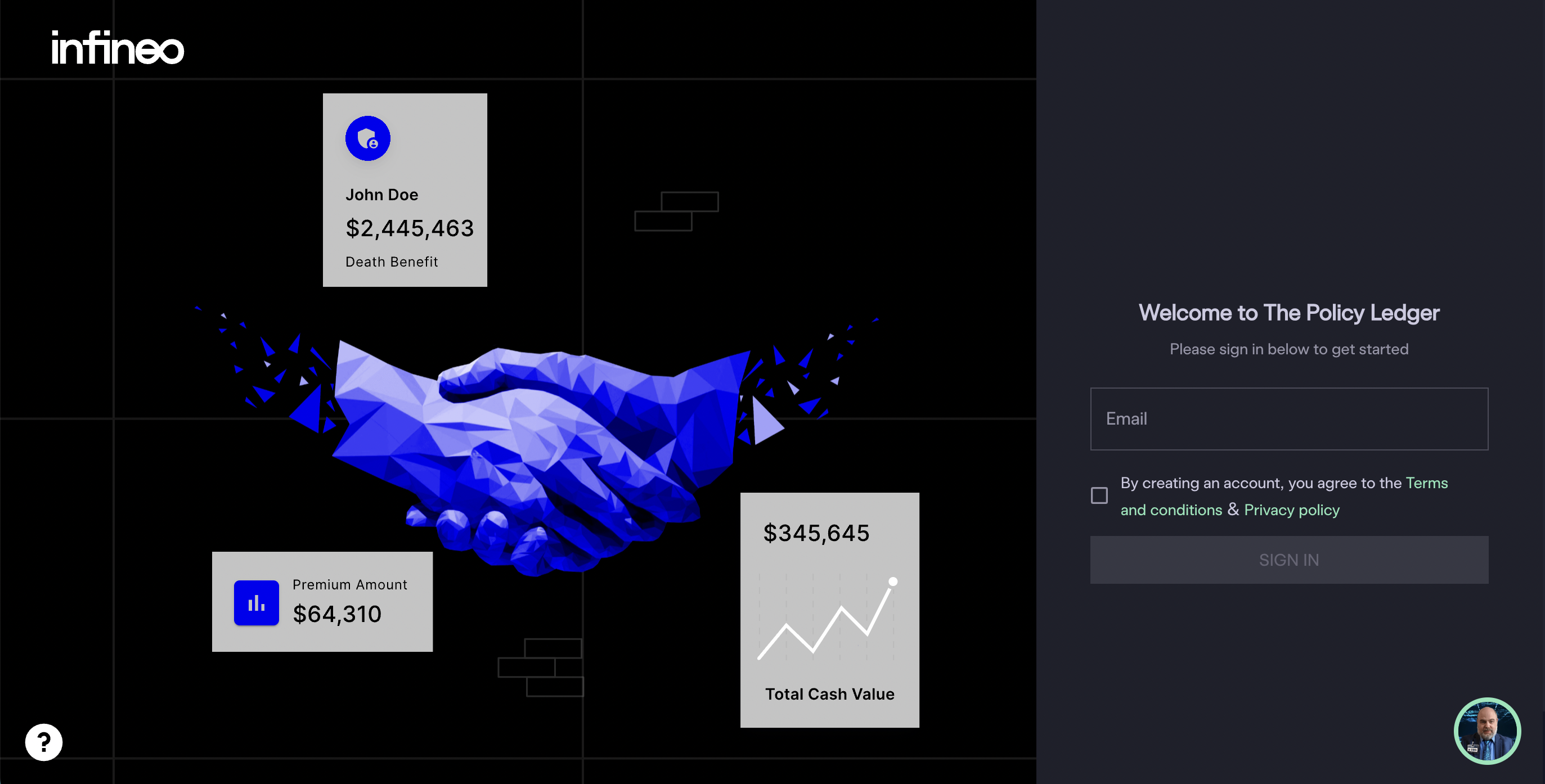

It is precisely for these scenarios that the infineo Policy Ledger was created. It allows owners to digitize their conventional life insurance policies, providing a backup notification system that will ensure that all of the hard work and foresight made during your life isn’t held up by red tape after your death.

Industry insiders have known for years that there are billions of dollars of unclaimed life insurance benefits, where the carriers owe money to designated beneficiaries but they simply can’t locate them. The infineo Policy Ledger solves this problem, ensuring that anyone who links their policy to the infineo ecosystem will sleep soundly knowing that their own beneficiaries will be given all of the needed information when the scenario arises. And this is also good for the life insurance industry, which wants their customers to know that their policies will do the job they were designed for. Even putting aside the extreme cases of death benefits going unclaimed, the infineo Policy Ledger makes things much smoother for the next of kin when they have more important things to be dealing with.

To learn more about the infineo Policy Ledger, and to watch a step-by-step video showing how you can onboard your own life insurance policy, please follow this link.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

LinkedIn: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

Comments