Has the Fed Achieved a Soft Landing?

In conjunction with last week’s reports on the latest economic data (see the Heather Long tweet), Fed chair Jay Powell announced that Fed staffers were no longer predicting a coming recession.

-2.png)

The combination of good news and the Fed forecast took hold of the online economics commentary, with economists explaining how their frameworks fit in with the new “reality” that a recession was no longer in the offing. This tweet from Adam Ozimek was typical of the mainstream approach:

-2.png)

On the other hand, members of the heterodox Modern Monetary Theory (MMT) camp were congratulating themselveson never having fallen to the (alleged) recession fear-mongering:

-2.png)

To give yet another example, in mid-July in the Wall Street Journal economist Alan Blinder argued that “Team Transitory” — of which he was a member — should be forgiven for downplaying the risks of the coming CPI inflation back in 2021 and 2022, because after all the Fed had brought inflation under control without the need for massive unemployment — just like Team Transitory had been arguing. Paul Krugman made similar claims recently in a NYT column, partially exonerating himself for his erroneous inflation predictions after Covid.

My nuanced reaction to all of this commentary is twofold: First, the notion that lower (price) inflation requires higher unemployment is a discredited relic of the Phillips Curve, which was supposedly discredited in the 1970s stagflation.

Second, even though I reject in general the idea that “tight money” market goes hand in hand with “slack” in the labor market, I disagree with the Fed staffers and all of the other economists cited above: I don’t think we are in store for a “soft landing.” I think the Fed’s unprecedentedly loose money policies after Covid have set us up for a crash.

The Keynesian Phillips Curve

In the 1950s and 1960s, the reigning Keynesian orthodoxy posited an alleged tradeoff between inflation (by which they meant consumer price inflation) and unemployment. This relationship was grounded in a framework where aggregate demand drove the macroeconomy. If inflation was high, it was because the economy was “running hot” with a tight labor market, where employers offered rapid wage hikes to attract workers, which then spilled over into rapid price hikes.

The idea was that the Fed could tame such inflation all right, but only by slamming on the brakes by jacking up interest rates and slowing the rate of new money creation. This would quash aggregate demand, leading to a spike in unemployment. The slackness in the labor market would keep wage growth contained, so workers could no longer afford to keep bidding up product prices.

Along the way Chicago School economists like Milton Friedman and Robert Lucas offered theoretical critiques of the Phillips Curve, but the “stagflation” of the 1970s was the death blow to the original conception. Policymakers were supposed to have a choice between high inflation or high unemployment, but in the late 1970s they were faced with both at the same time. This experience led many economists to conclude that in the long run, there isn’t a tradeoff between a strong currency and strong labor market; you can have low inflation and low unemployment, so long as the central bank has a consistent policy to which everyone adapts.

We’re Not Out of the Woods Yet

Even though the old school version of the Phillips Curve had been discredited, old habits die hard. The mainstream press and even much of the economics profession still cling to a short-run version of the Phillips Curve, because they still view the world through the lens of aggregate demand.

From this perspective, the fact that the Fed has contained CPI inflation by hiking rates so aggressively — from basically 0% in March 2022 to 5.25% in July 2023 — without a spike in unemployment, means that we have achieved a so-called “soft landing.”

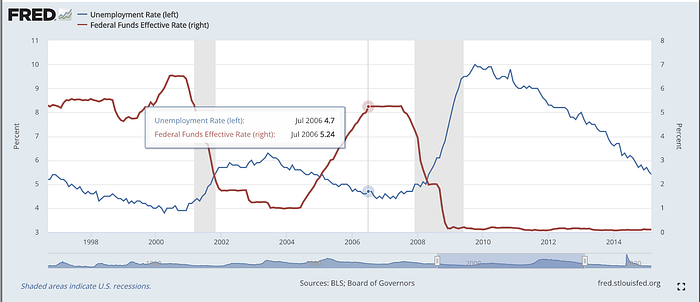

Yet from the rival Austrian School perspective, the easy-money regime led to massive malinvestments. The deeply inverted yield curve is a tell-tale symptom that a crash is coming. For additional historical evidence, consider the lead-up to the Great Financial Crisis:

As the chart shows, the Fed (then under Alan Greenspan) had sharply cut interest rates following the dot-com bust, reaching 1% in June 2003. After holding rates at that level for a year, the Fed then steadily hiked rates up to 5.25% in July 2006. (Sound familiar?) Unemployment at that point was 4.7 percent, had been steadily falling for years, and it kept declining for several months afterwards.

Given the framework of the mainstream economists, they would have thought at that point that the Fed had achieved a soft landing. (Indeed, Ben Bernanke had a string of appearances starting around this time, assuring everyone the economy was in good shape.) Yet as we know, the US was on the brink of entering the worst recession since the Great Depression.

Despite the excuses and victory laps from various commentators who think the danger is over, I believe we are not out of the woods. Both theory and history tell me that a bad recession is definitely still in the cards.

This article was released 24 hours earlier on the IBC Infinite Banking Users Group on Facebook.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Comments