Inflation and Unemployment

In all the talk of a “soft landing”—which I don’t think we will get in 2024—the underlying dispute among professional economists concerns the validity of the so-called Phillips Curve. This analytical device postulates a tradeoff between (consumer price) inflation and unemployment. It is typically associated with Keynesian economists, who argue that if the central bank wants to reduce inflation then it can tamp down Aggregate Demand, but that this will have the unfortunate byproduct of throwing people out of work.

In contrast, typical non-Keynesian economists (such as members of the Chicago or Austrian schools) reject the Phillips Curve mentality, at least in the medium- to long-run. They argue that once everyone in the economy adjusts to the central bank’s policies, there is no tradeoff between inflation and unemployment. Even with a “tight” monetary policy that keeps consumer prices relatively stable, workers will be able to find a job because wages will adjust to other prices.

In this context, the fact that US CPI inflation has come down quickly without a surge in unemployment has given economists yet another thing to fight about. But even though in general I agree with the anti-Keynesian view, in our specific circumstances in the US right now, I do think the Fed’s recent conquest of inflation (through aggressive tightening) will cause a recession. Indeed, this is an application of the Austrian theory of the business cycle, developed by Ludwig von Mises and elaborated upon by Friedrich Hayek.

I will use a 2022 Twitter thread from George Selgin (who does not call himself an Austrian but is steeped in the tradition) that has been resurfaced recently in celebration, to showcase what I think my colleagues are missing in this present debate.

Selgin on the Alleged Inflation/Unemployment Tradeoff

Here is Selgin’s Twitter thread, originally posted in April 2022 (and recirculated by another economist in December 2023 who believes events have vindicated Selgin):

To avoid confusion, I agree with the policy recommendations of Selgin and others who blamed the Fed for the surge in US consumer price inflation that began in early 2021. But my point is that given such an aggressive “loose” monetary policy, the mechanism of Austrian business cycle theory has been activated.

Bankers Gone Wild

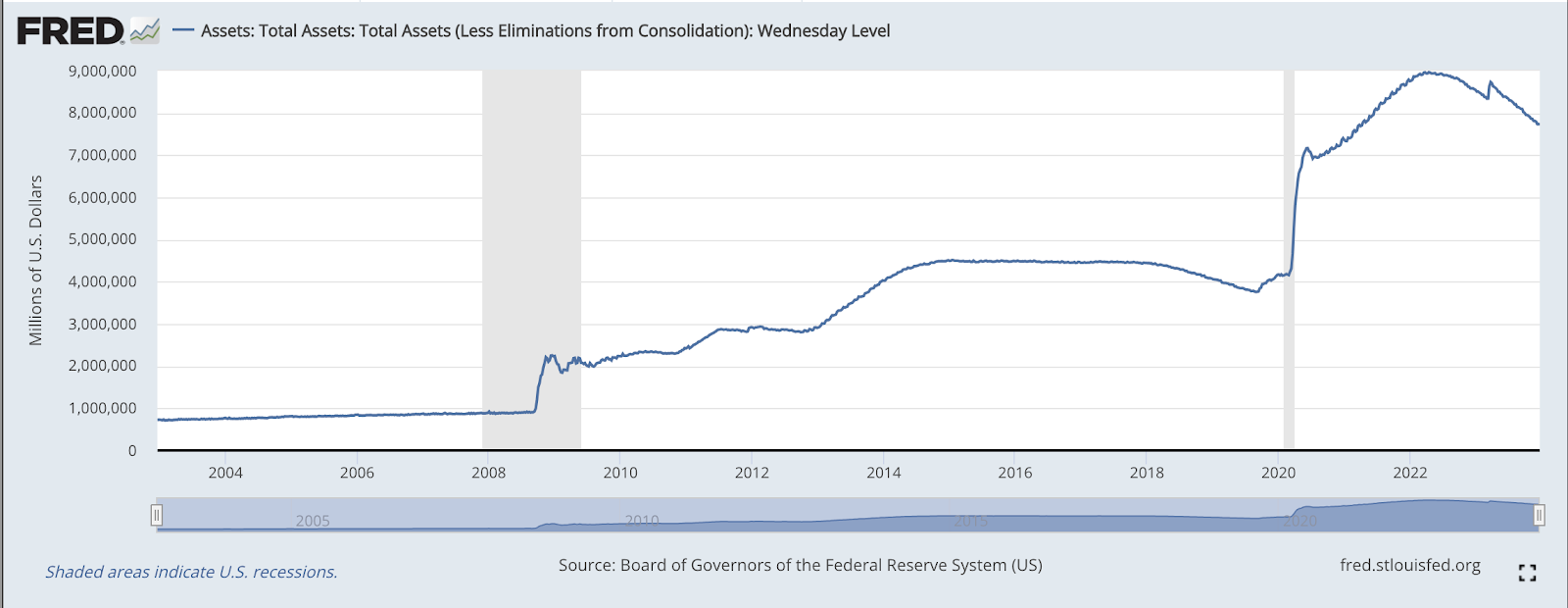

Specifically, from the onset of the Covid crisis through April 2022, the Fed increased its balance sheet by some $4.7 trillion, more than doubling its assets:

Along with the quantitative easing shown in the chart, when Covid hit the Fed also slashed short-term interest rates back down to zero, and then began raising them very aggressively in March 2022.

Hard Landing Coming

I agree with Selgin (and other anti-Keynesians) who argue that, as a general rule, there is no tradeoff between inflation and unemployment. If the central bank adopts a “tight” policy, once everyone adjusts to the new reality, we can enjoy full employment along with a strong and stable currency. After all, I’m a proponent of sound / hard money, and think we would be much better off if government got out of the industry altogether and let the market produce gold coins as the voluntary money.

But that’s not the full context of our current situation. Unlike Selgin (whom I debated in New York City on the matter), I think that aggressive expansion of bank credit is what sets up an unsustainable boom that leads to an inevitable crash. So given what the Fed did from 2020 through early 2022, I think its tightening will indeed lead to a recession, as I elaborate in this discussion with Keynesian economist Dean Baker.

NOTE: This article was released 24 hours earlier on the IBC Infinite Banking Users Group on Facebook.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

LinkedIn: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

.png?width=520&height=294&name=400%20oz.%20(19).png)

Comments