Minimum Wage Hikes Don’t Help Poor Workers

On April 1, California’s statewide minimum wage increased from $16 to $20 per hour. Critics of the hike flooded social media with anecdotes of various fast food restaurants laying off workers and/or hiking menu prices. Supporters of the move, for their part, pointed to the academic economics literature that has become much more sanguine about the impact of modest minimum wage hikes on employment.

Amidst this controversy, I saw a post from a Kantian philosophy grad student whom I follow on Twitter, who had retweeted a critic of the California hike and thought the purported tradeoff between worker wages and burger prices was an “obviously good trade.” I asked if the question were sincere, and—upon hearing that it was—said I would devote my next post to explaining why this alleged trade was not obviously a good one.

In this post, I am not going to (re)litigate the enormous empirical controversy about whether minimum wage hikes reduce employment among low-skilled workers. If you want to see my summary of the arguments in the empirical literature, see this post and this post. My one-sentence takeaway is that even the papers finding a negligible impact are only calibrated on modest hikes; even the most pro-minimum wage studies don’t justify the most aggressive “livable wage” demands.

Rather than argue about whether California’s law will make it harder for the intended beneficiaries to get jobs in the first place—thus reducing their “minimum wage” from $16 down to zero—instead I want to point out a separate aspect of this discussion that almost never gets mentioned: Even on its own terms, minimum wage hikes likely transfer money (on net) from poor working parents to middle class teenagers.

The Mental Model of the Minimum Wage Supporters

Among the rank-and-file supporters of minimum wage laws—and what seems to be true of the Twitter account I screenshot above—there is at least an implicit model of the economy that goes like this: Big employers such as fast-food franchises have lots of bargaining power, whereas struggling workers with little education and job experience need a job, no matter how miserable the conditions or measly the wages. In this context, wages aren’t set by “marginal productivity” and other fancy terms that libertarian economists throw around, but instead are a race to the bottom. Fast food joints pay their workers the bare minimum that the government allows, and that’s why they’ll only give raises when the government forces them to.

Even on its own terms, this worldview is dubious, because of the brute fact that the overwhelming majority of American workers earn more than the (federal) minimum wage. Specifically, the Bureau of Labor Statistics reports that in 2022, a mere 1.3 percent of workers earning hourly wages made the minimum wage or less. (That means that if you include all workers—including those who are paid a salary—the actual share of total workers earning the minimum wage falls even more.) So if this is a story about “market power” and the fact that the capitalist wage-slaves are “free to starve,” you might have expected a lot more workers to be earning the bare legal minimum that the government requires. But again, the simple fact is that 98.7% of hourly workers make more than what the federal government requires.

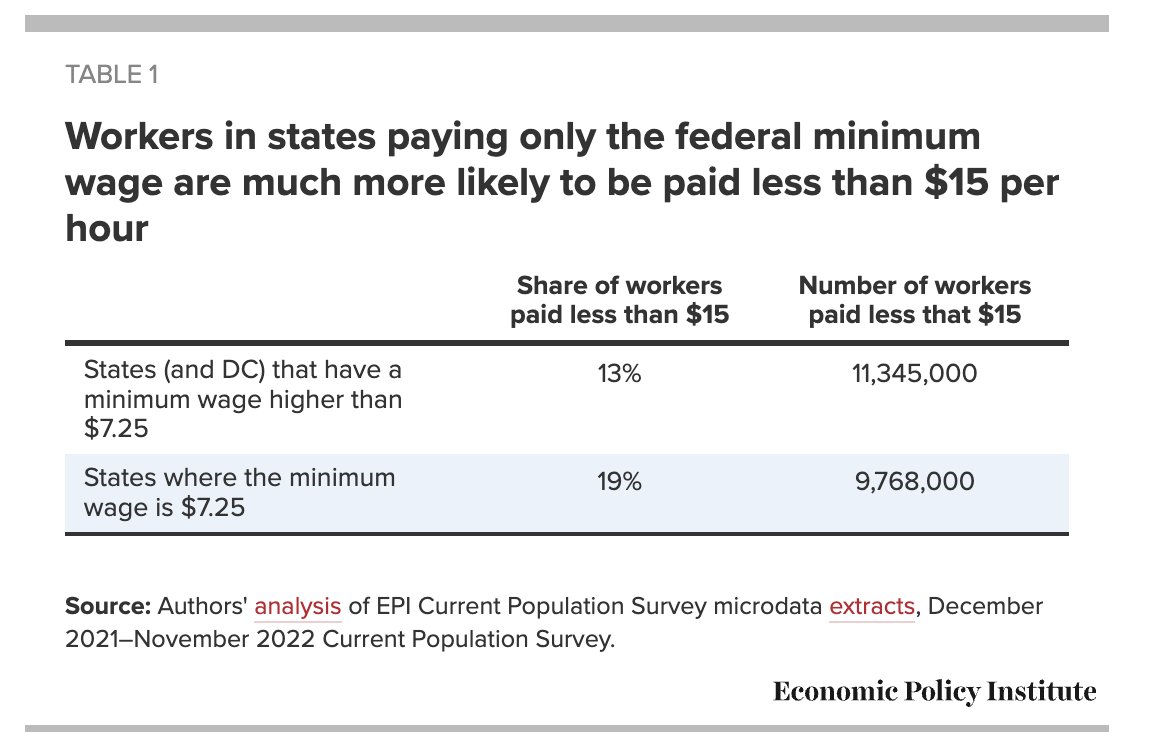

Now in fairness, 30 states (and the District of Columbia) have their own minimum wage thresholds that exceed the federal level. So ideally, we would want to look at only the 20 states that match the federal level—or, what is the same thing, don’t have a state minimum wage at all—and see what percentage of their workers earn just the minimum (or less, if they are exempt). I couldn’t find such a statistic handily, but I did find the following table from an outfit that is pro-minimum wage hikes:

Again, the rhetorical purpose of the above table is to make the reader support a federal $15 minimum wage. But even on its own terms, the table indicates that in states where the prevailing legal minimum is $7.25 per hour, 81% of workers earn more than double that. That is hard to reconcile with a crude “employers have all the bargaining power” model. And so if someone’s worldview is based on such a crude model—in which case, hiking the minimum wage merely transfers wealth from the fat cats to the helpless workers—then it’s probably a good idea to study the issue more before supporting policies that tinker with these markets.

Most Poor Workers Earn More than the Minimum Wage, and Most Minimum Wage Workers Aren’t Poor

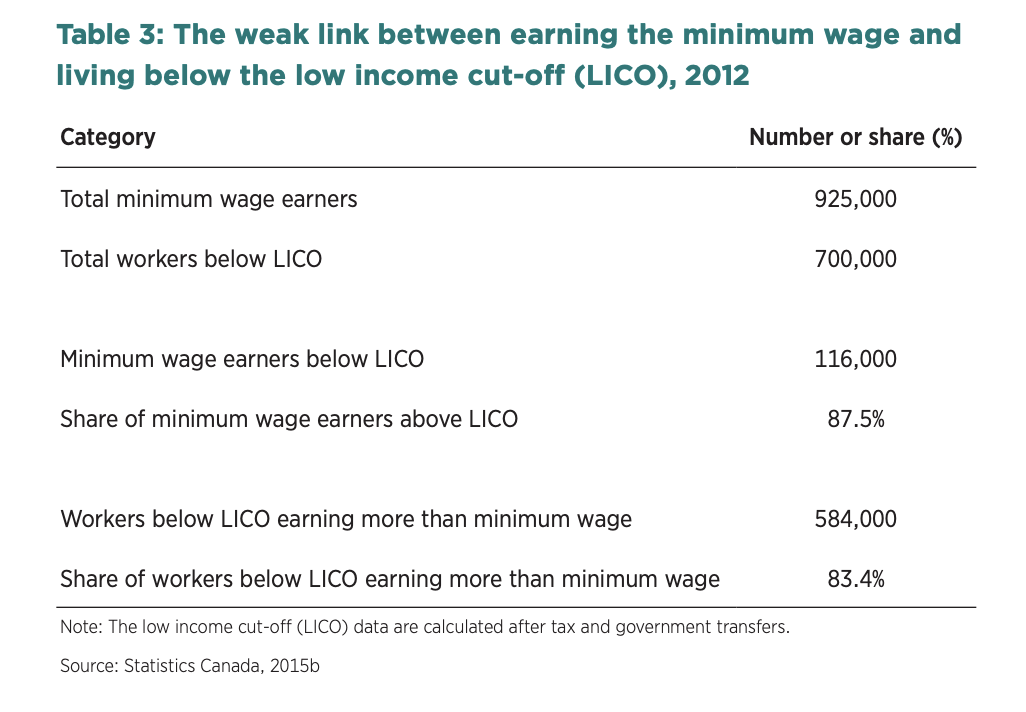

To make the main point of the present post, below I reproduce a table from a report I co-authored regarding minimum wage hikes in Canada:

In Canada, the low income cut-off (LICO) is a threshold for distinguishing whether a family should be classified as low income (or what other researchers might call “the poverty line”), but it has seven different family sizes and five different community sizes, for a total of 35 thresholds.

As the table above indicates, the 2012 data (which was the latest at the time of our report) showed two important facts:

First, if we looked at all of the Canadians earning the minimum wage, then 87.5% of them lived in households that were above the LICO threshold.

Second, if we looked at the workers who belonged to households falling below the LICO threshold, then 83.4% of them earned more than the minimum wage.

I couldn’t find the exact counterparts of these statistics in recent US data, but I did find this BLS study way back from the 1980s, which reported: “In March 1985, one in five hourly wage workers paid at or below the Federal minimum wage of $3.35 per hour lived in households with incomes below US poverty levels.”

The purpose of the report was to underscore the plight of these “one in five” minimum wage workers who lived in households below the poverty line. But of course, the flip side of the statistic is that four in five workers—meaning 80%—earning the minimum wage came from households above the poverty line.

Making Sense of the Data

What’s going on here? The simple fact is that the people earning minimum wage are disproportionately young workers with no prior job experience. The typical minimum wage worker is more likely to be a suburban kid taking a first summer job, not a working couple with a few kids. (You have to be careful with reports like this one from the GAO, which focus on minimum wage workers 25 years or older and find that many come from households in poverty. Those statistics are entirely consistent with the other data I am reporting.)

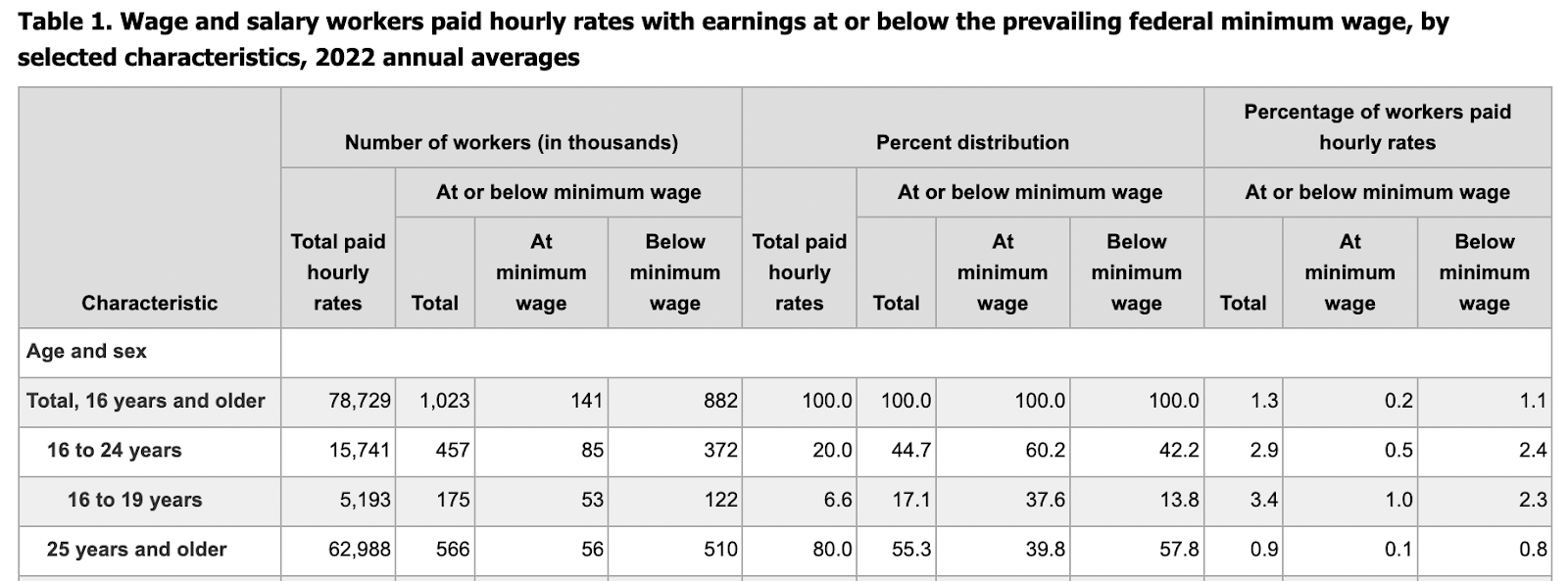

To get an idea of the breakdown, consider the following summary of the 2022 data by the BLS:

For example, of the 1.023 million workers earning at or below the federal minimum wage in 2022, 457,000 (or 44.7%) were aged 16 to 24, while the remaining 566,000 (or 55.3%) were 25 and older.

However, there are a lot more workers aged 25 and older, than those only 16 to 24. So even though the younger workers constitute a little less than half of all minimum wage earners, they are much more disproportionately represented.

Specifically, 2.9 percent of workers aged 16 to 24 earned at or below the federal minimum, while a mere 0.9% of workers aged 25 and older earned it. (And to really push it, the table also shows that of workers aged 16 to 19, the percentage earning at or below the federal minimum jumps to 3.4%.)

To put it in other words, in 2022 if you were aged 16 to 19, you were a whopping 278% more likely to earn at or below the federal minimum wage, than if you were aged 25 and older.

The Conclusion

If you are the kind of person who thinks big business “passes costs through” to their customers, then the California minimum wage hikes are paid via higher food prices. There are a lot of working parents who go through a McDonald’s drive through per hour, especially in poor urban communities. These working parents typically earn much more than the minimum wage, even though their households are below the poverty line.

So according to the economic model held by most proponents of minimum wage hikes, these working parents have to hand money over to the workers at fast food restaurants, who are disproportionately under 20 years old and live in households above the poverty line.

I am not claiming that this post makes an airtight case, but I hope I’ve done what I told my Twitter acquaintance I would attempt: I tried to show that it is not obvious that raising meal prices to fund a minimum wage hike is a good thing, from an egalitarian perspective.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

Linkedin: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

Comments