MMT and Treasury Debt Payoff Part 2 of 2

In Part 1 of this series, I explained that I had recently been in a Twitter battle where several fans of Modern Monetary Theory (MMT) were arguing that it was crazy for fiscal hawks to be wringing their hands over the national debt. They claimed that if one understood basic accounting—as applied to a “monetary sovereign” such as the US or UK governments—then one would realize that paying off the government’s debt would eradicate the money supply.

I demonstrated through straightforward arguments that this clearly wasn’t true when it came to government debt held by the citizenry at large (or foreign governments, for that matter). Specifically, if the Treasury taxed (say) $100 billion from the people, and then used those funds to retire $100 billion of the Treasury bonds held by the people, the obvious result would be a reduction in the outstanding Treasury debt without changing the number of dollars held by the people. The Treasury could repeat this process until all of the outstanding Treasury debt was paid off, by running a corresponding budget surplus (during that period) of the same dollar amount.

However, one loose end in my argument was that a large chunk of the existing Treasury debt “held by the public” is actually sitting on the balance sheet of the Federal Reserve banking system. And since the Fed is the institution responsible for issuing legal tender US dollars, that awkward fact surely complicates things.

In the present post, I will tie up this loose end by showing what would happen to the supply of US dollars if the Treasury went all the way and retired even those Treasury bonds currently held by the Fed.

The Fed’s Balance Sheet

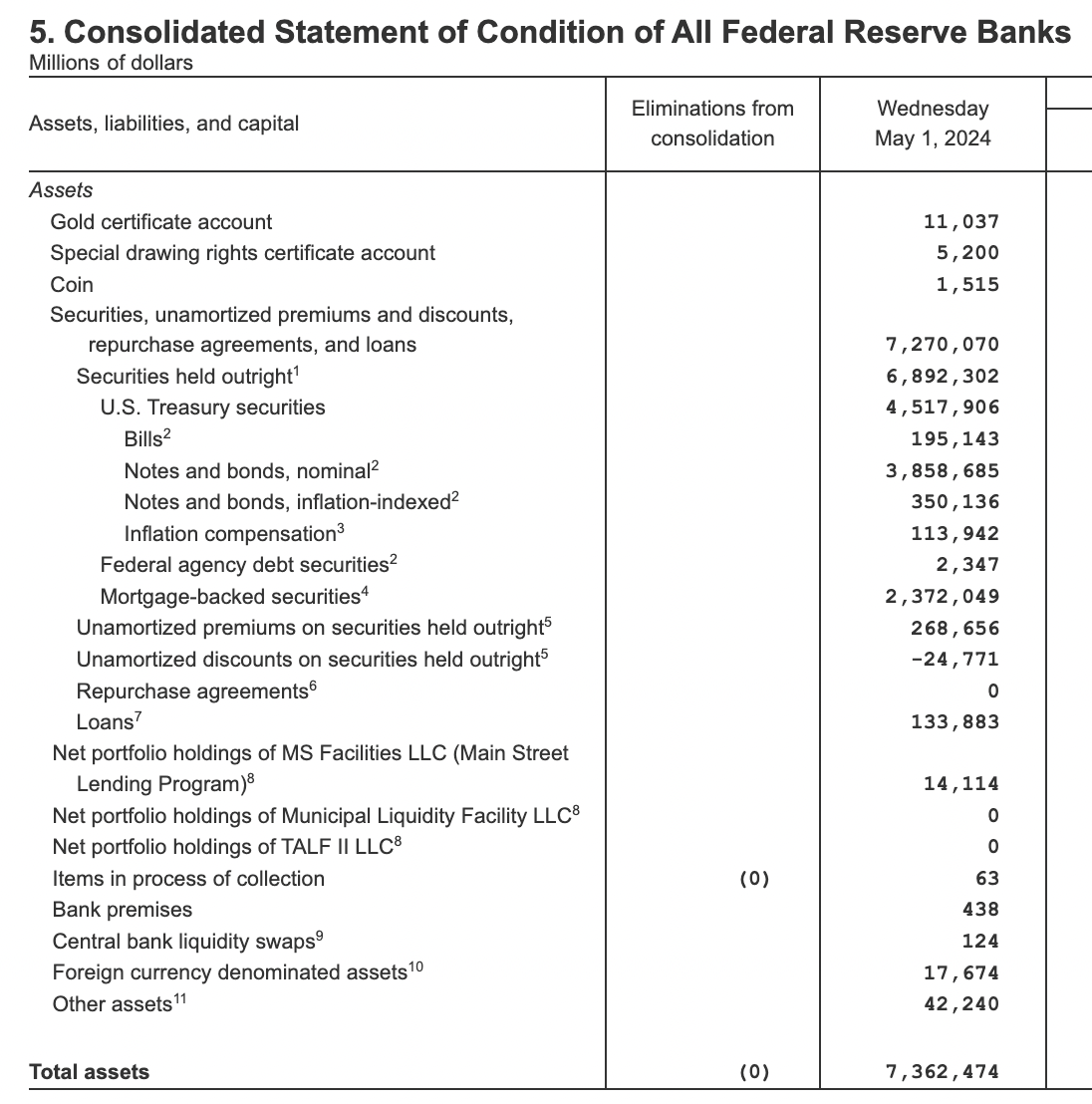

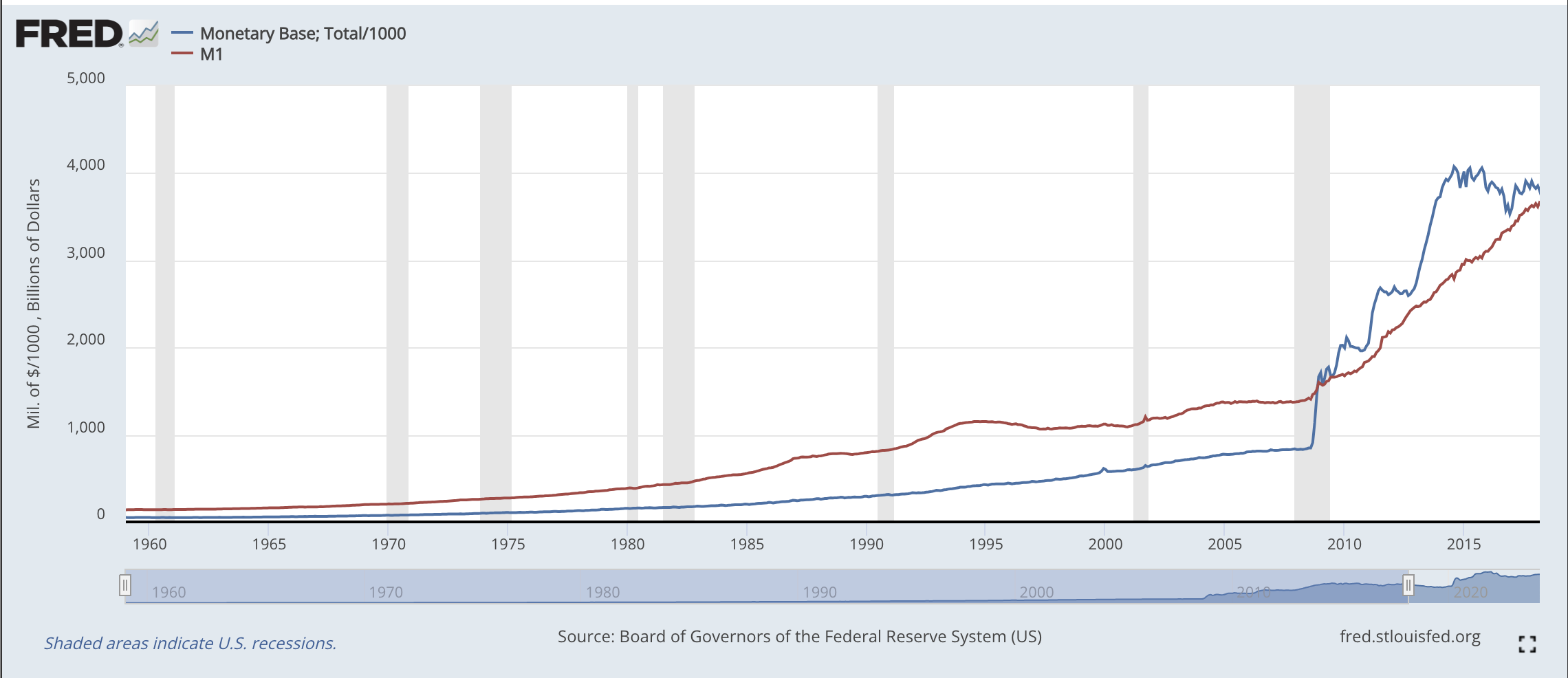

As documented in the May 2, 2024 version of the Fed’s H.4.1 release, here are the consolidated assets and liabilities for the Federal Reserve Banks:

I’ll do the “MMT kill shot” very quickly, to keep this post as succinct as possible. The asset table shows that the Federal Reserve is currently sitting on $4,517,306,000,000—in words, four trillion, 517 billion, 306 million dollars—of Treasury securities held outright. The liability table shows that the US Treasury’s General Account with the Fed currently has $890,442,000,000—in words, $890 billion and change—in it. So if the Treasury used the money it currently has in “checking” in order to redeem some of the public debt held by the Fed, that would knock down the outstanding Treasury debt to $3.6 trillion. That’s the new number the Treasury would have to extinguish, if we really wanted the federal government to “pay off the debt.”

Now one might be tempted to do this simply through a bookkeeping calculation, by viewing the Fed+Treasury as a consolidated entity. From an MMT perspective, this would be entirely appropriate, since that’s how they frame these matters.

But for the benefit of the reader, let’s assume the Treasury continues to tax the general citizenry in order to come up with the dollars in order to buy back the remaining Treasury bonds (which, at this point in our tale, are now held exclusively by the Fed). First, let’s say the Treasury taxes $100 billion that are paid in actual paper currency—green pieces of paper with photos of dead men on them—to the IRS. The Treasury then hands that physical currency over to the Fed, and the Fed gives the Treasury $100 billion worth of the Treasury bonds it’s holding. The Treasury would then run the bonds through the paper shredder, and the Fed would run the $20 and $100 bills through the paper shredder.

As a result of this operation, the “national debt” would have dropped another $100 billion, and the Fed’s liability line item “Federal Reserve notes, net of F.R. bank holdings” would drop by $100 billion. It is here that the germ of truth in the MMTer claim—namely, that paying off the debt would shrink the money supply—shows up. Once we have whittled down the outstanding Treasury debt to that held on the Fed’s books, it’s true that further pay-down would indeed reduce the quantity of legal-tender US dollars in existence.

Even so, would the economy “run out of money” by the time the Treasury finished the job? No. As the liabilities table above reveals, there are currently just shy of $2.3 trillion of US currency in existence (which is counted as a liability of the Fed), as well as $3.3 trillion in deposits at the Fed by banks (not counting the US Treasury’s General Account). In our system, when a regular bank holds a “checking account” balance at the Fed, that counts as legal-tender money just as much as a $20 bill. So the total amount of “official US dollars” held outside the US government system as of May 2 was $5.6 trillion.

Above we showed that after the Treasury drained its existing checking account balance with the Fed, there would be remaining $3.6 trillion in Treasury debt. So if the IRS taxed $3.6 trillion from the citizenry—collected in a mixture of paper currency and checks written on banks—it could completely extinguish the Treasury debt, and the outside world would still be holding some $2 trillion in official USD legal tender money.

I want to be crystal clear: When I say that there would still be some $2 trillion in official USD in existence after completely paying off the federal debt, I am not talking about loans issued by commercial banks. I am talking about official USD, meaning physical currency ($20 and $100 bills) and reserves that the banks themselves have parked at the Fed—which, upon request, could be turned into green pieces of actual paper currency, if the banks wanted.

And so we see, those MMTers who were confidently telling me that “accounting” showed that paying off the US debt would eliminate all of the dollars, were utterly wrong.

What Was the Twitter MMTers’ Mistake?

The fundamental problem with the MMTers on Twitter who kept pushing this argument (even after my first post last week, which should have given then an inkling that something was seriously wrong with their framework), is that they were assuming that all of the Fed’s liabilities of USD (whether in paper currency or reserves by depository institutions) matched dollar-for-dollar with the Treasury securities that the Fed holds as assets. But as the tables above indicate, that’s simply not true.

For example, the Fed is still holding $11 billion of gold certificates from 1934 when the Roosevelt Administration confiscated the Fed’s gold (at the steal price of $20.67 an ounce). It’s holding about $18 billion in asset denominated in foreign currencies. And a big whopper, The Fed is currently holding some $2.4 trillion in mortgage-backed securities.

So in general, even with a “monetary sovereign,” there’s nothing in the MMT accounting stopping it from buying gold, bonds issued by private corporations, or even Australian real estate for that matter, in order to have an asset on its books corresponding to a new issuance of USD (which show up as liabilities on its books).

And for another curveball, even if the Fed did strictly use only Treasury securities for its assets (as historically was closer to the truth, before the 2008 crisis), changes in interest rates could make the Fed’s assets and liabilities no longer match. (That’s actually why the Fed is currently insolvent in an accounting sense, as we explain in this podcast episode.)

This whole situation is ironic, because the MMTers who scuffled with me were relying on armchair reasoning, without an empirical investigation into the actual magnitudes of the Fed’s balance sheet. I say this is ironic because the MMTers love to congratulate themselves on how unbiased they are in simply “describing the modern monetary system” (at least for governments such as the US and Japan) while it’s allegedly the fuddy-duddy Austrians who engage in a priori theorizing without looking out the window.

More specifically, many of the MMTers have a view—either implicitly or in some cases, they spell it out explicitly—that at some point in the past, there were zero US dollars. Then the Treasury+Fed issued net new dollars into the financial system, which (according to traditional accounting) would have to be classified as a budget deficit, because there were no dollars in the beginning with which the public could have paid taxes.

It's actually a bit hokey if you try to start this analysis at Day 1, when there allegedly are no USD and no Treasury debt, and try to get it off the ground. In order to make it work out, you have to do funny stuff like allow the public to buy newly-issued Treasury bonds by reducing their anticipated first year tax bill, so that the Treasury+Fed entity can inject money into the economy while keeping a dollar-for-dollar “public debt” being racked up on the Fed’s books.

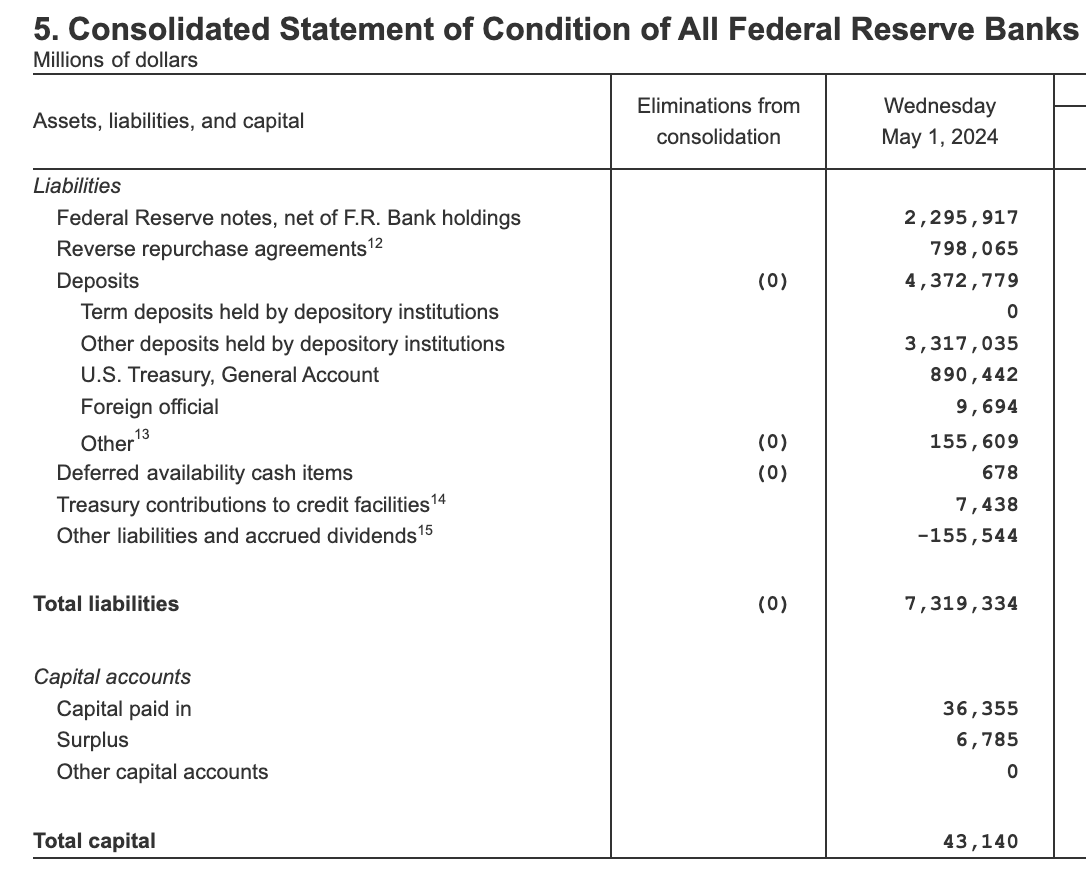

But anyway, if you force it, with this framework you can tell a “just so” story in which, fast forwarding into the future, at any given time, the total amount of official USD and Treasury bonds held by the citizenry (i.e. outside the Treasury+Fed nexus) is equal to the accumulated history of how much the Treasury+Fed nexus spent over and above what it collected back in tax receipts. (Again, even here you have to ignore capital gains/losses due to interest rate swings, but put that aside.) And so that’s why many of the rank-and-file MMTers think “if the government ever foolishly paid off the debt, we’d run out of dollars,” and they post graphs like the one below to apparently “prove” their point with simple accounting of the sectoral flows:

So to be clear, it’s not that the specific accounting tautologies from the MMTers are wrong in and of themselves, it’s just that they are a clumsy way of framing the issues and often mislead their adherents into demonstrable error (such as in the present case).

What About My 2010 Article?

The last loose end I have to tie up is the admittedly awkward fact that back in 2010, when reviewing some excerpts from the cult classic book The Creature from Jekyll Island, I wrote this statement: “[I]f people in the private sector ever paid off all of their debts, and the federal government paid off all of its bondholders, then the supply of US dollars would be virtually extinguished.”

So what the heck is going on here? Was I wrong back then, or am I wrong now?

The resolution is that in my 2010 article, in context when I was talking about “the supply of US dollars” I didn’t mean just the official legal-tender money consisting of paper currency and bank deposits held at the Fed. I meant money in the broader sense (such as captured in M1), which includes the public’s checking accounts at commercial banks. And notice that in my statement quoted above, I said “if the people in the private sector ever paid off all of their debts” as the starting point.

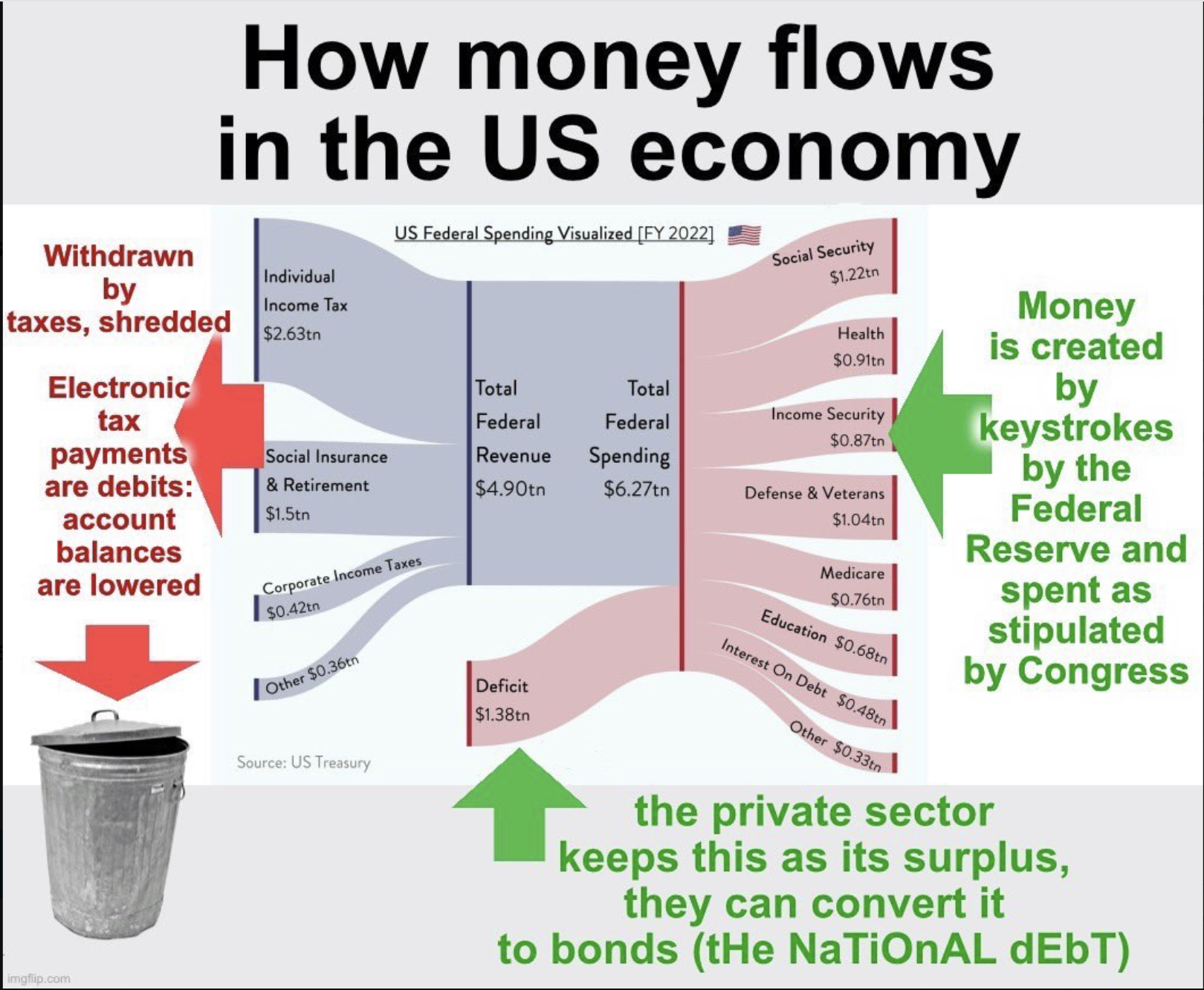

Before the 2008 crisis—and so this pertains to the quotes from Jekyll Island that I was analyzing in a sympathetic light—most of the money held by the public was in the form of checking account balances, rather than official legal tender USD. (Of course, in normal times the two trade freely at par, which is why economists include checking account balances in the higher monetary aggregates.) That relationship flipped after the 2008 Fed actions, but the below chart shows how historically M1 (which includes checking accounts) was higher than the monetary base (which is currency and reserves held at the Fed):

So as I spell out in the 2010 article (and go read it if you want to see the details), in our fractional reserve system, when commercial banks “create money out of thin air” they do so by issuing loans. Therefore, if the public paid back loans issued by commercial banks, other things equal this would reduce M1 and the higher monetary aggregates, thus “shrinking the money supply.” This is actually what caused such a crunch in the early 1930s; the Fed itself had an easy money policy, but the panic led the public to pull their money out of the banks and thus cause M1 to crash.

In addition, it was the general rule, pre-2008, that the Federal Reserve would only buy government debt as the assets to effectively correspond to new money it issued into the economy. In other words, before the 2008 crisis, if we did the same exercise as I had done above with the Fed’s balance sheet, the outstanding amount of currency and bank reserves would have more closely corresponded to the Treasury debt held by the Fed. Hence, in context this is what I had in mind when I wrote the above-quoted sentence.

Conclusion

In wrapping up, one last point: Does all of this mean that the MMTers at least were basically right, before 2008? Not really. If you inspect their actual arguments, at least for some of the people brawling with me on this topic they would also be committed to saying that if the Treasury only paid off half of its debt, then the supply of USD would shrink in half.

But as we’ve seen, that’s not true at all. Again, to reiterate the important point from last week’s post: At any time—either right now, or back in 1950—the Treasury could run budget surpluses and retire the outstanding national debt held outside of the Fed without reducing the quantity of US dollars by a penny. So when the MMTers mock fiscal hawks for thinking governments need to get their spending under control, it is ludicrous to argue that belt-tightening would imply a reduction in the money supply. Nobody in power is proposing to completely eliminate the US, UK, or Japanese government debt anytime soon. Linking fiscal hawkishness to an elimination of the money supply is an absolute non sequitur.

In conclusion, whether we mean in strict theory or in loose political discourse, it is utterly false when the rank-and-file MMTer argues that paying off the government debt would wipe out the money supply. Even though the more senior MMT gurus may be more careful in their statements, the framework they espouse in their books and speeches understandably leads their followers into making such gross errors.

NOTE: This article was released 24 hours earlier on the Infinite Banking (IB) 3.0 - The Future of Finance Group

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

LinkedIn: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

Comments