Parsing the Latest CBO Report on Federal Debt

The Congressional Budget Office (CBO) recently released its latest 10-year forecast for US economic growth and fiscal position. Everybody knows at this point that Uncle Sam is drowning in debt, but it’s worth pointing out in this post just how bad the situation is right now. The CBO isn’t showing that things will start getting unsustainable down the road; the situation is already untenable.

Before diving into the report, I want to add a personal note: It is common to refer to CBO as “nonpartisan,” and I know this probably engenders a cynical chortle from many readers. However, in my experience the CBO actually did try to present a balanced view with its economic outlook, including caveats from rival schools of thought on a particular matter. (When I was hip-deep in the carbon tax literature, they actually contacted me once to make sure the perspective from people who thought like me made it into their report.)

To be sure, I think the game is rigged to make the CBO “forecasts” more optimistic than what is warranted, but that’s because they are tasked with projecting current legislated policy (even if it assumes unrealistic budget cuts and/or tax hikes down the road) and they don’t build in economic crashes. Both of these choices are understandable, because it would open up a controversial can of worms to throw guesses about future policy changes and the timing of recessions into the mix. Thus, the CBO forecasts should be taken as a baseline projection of the momentum of the current regime, without adding in future shocks to the system.

Enormous Deficits Are Now Permanent

Right out of the chute CBO opens its latest report with a jaw-dropping claim:

The deficit totals $1.6 trillion in fiscal year 2024, grows to $1.8 trillion in 2025, and then returns to $1.6 trillion by 2027. Thereafter, deficits steadily mount, reaching $2.6 trillion in 2034. Measured in relation to gross domestic product (GDP), the deficit amounts to 5.6 percent in 2024, grows to 6.1 percent in 2025, and then shrinks to 5.2 percent in 2027 and 2028. After 2028, deficits climb as a percentage of GDP, returning to 6.1 percent in 2034. Since the Great Depression, deficits have exceeded that level only during and shortly after World War II, the 2007–2009 financial crisis, and the coronavirus pandemic.

To make sure the reader understands: CBO is saying the current (fiscal year) deficit of $1.6 trillion is the lowest the federal deficit will ever be, going forward. I can remember during the Obama years, when there were four consecutive years of trillion+ dollar deficits, and people were shocked when I explained that fact. But at the time, we were still in the near-wake of the global financial crisis, and so people understandably assumed Uncle Sam would tighten his belt once things returned to normal.

Welp, the new normal is that federal budget deficits will forever more be at least $1.6 trillion annually.

And the block quotation above also shows that these enormous numbers aren’t simply due to a growing economy or even inflation. As a share of GDP, the deficit will never fall below 5.2 percent going forward, according to CBO’s forecast. The old Keynesian nostrum of a “cyclically balanced budget”—where the deficits during recessions were counterbalanced by surpluses during boom periods—has long since died. The federal government is going to keep running in the red, it’s just that some years will drive up the debt more than other years.

The Federal Debt Now on a Runaway Trajectory

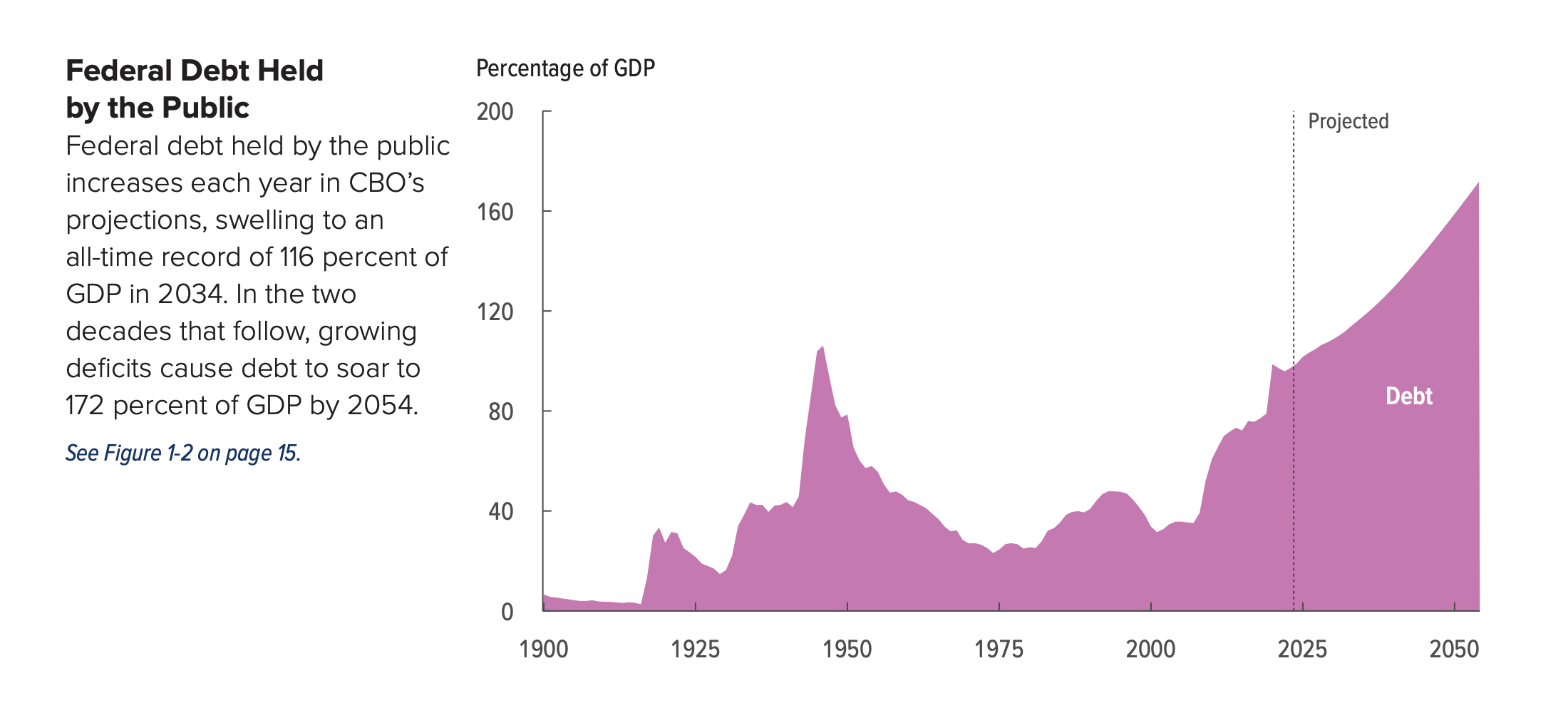

Given that the annual flow of budget deficits are projected to be permanently massive, CBO goes on to say that the cumulative stock of debt will mushroom as well: “Debt held by the public increases from 99 percent of GDP at the end of 2024 to 116 percent of GDP—the highest level ever recorded—by the end of 2034. After 2034, debt would continue to grow if current laws generally remained unchanged.”

Here’s a chart to illustrate how rapidly the debt grows:

It was understandable that the US federal debt soared back in the late 1940s, since the world was embroiled in a brutal war. After that one-shot crisis, federal spending fell drastically, allowing the debt to fall as a percentage of GDP (though not in absolute dollar terms) throughout the 1950s and ’60s.

Likewise, after the 2008 crisis and then again in 2020 with covid, there was a massive surge in government deficit spending due to the ostensible emergencies. But as the chart shows, this time around, the debt continues to explode even after the crises have ebbed. This fiscal train wreck isn’t going to fix itself without massive (and painful) policy changes.

What’s Driving the Deficits?

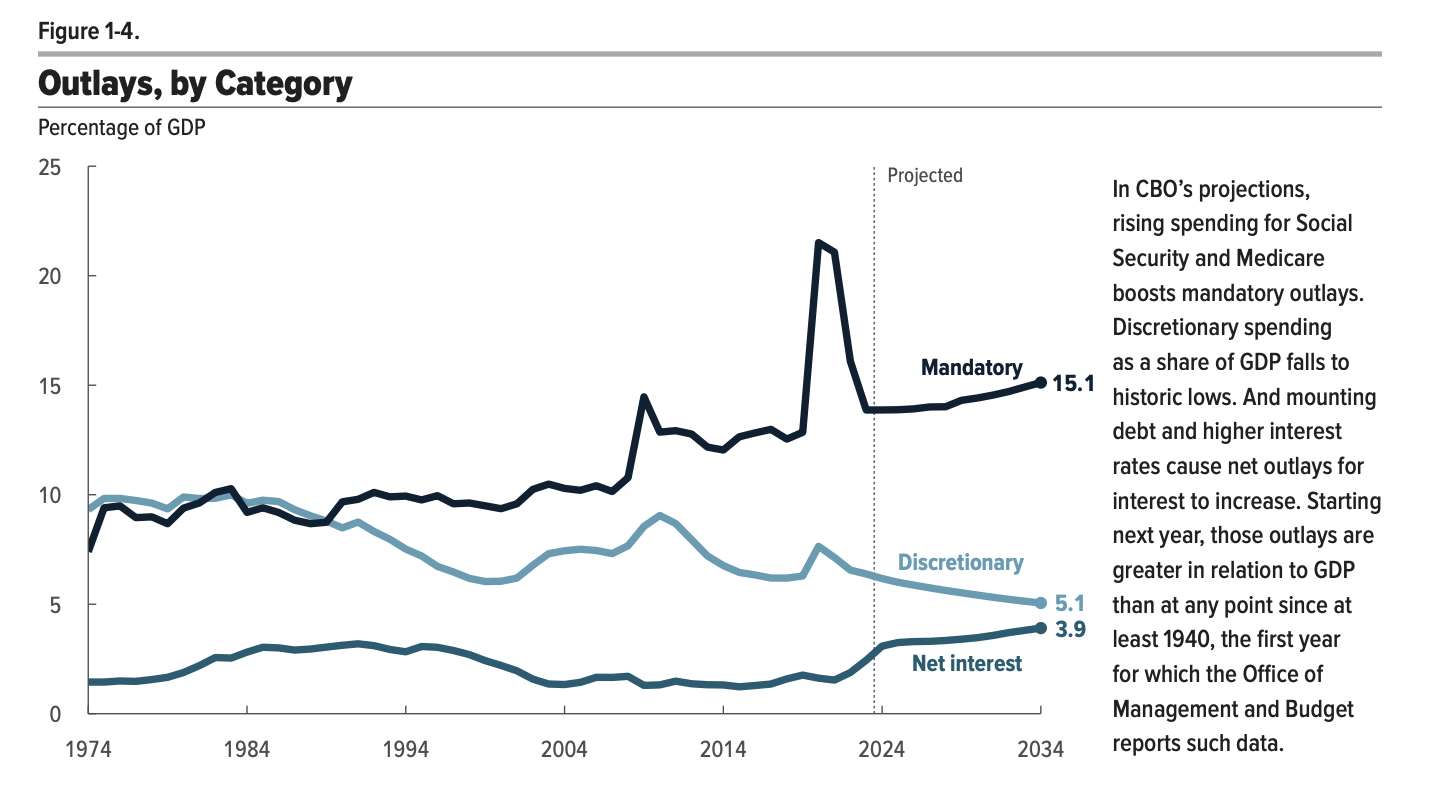

Finally, to show just how entrenched this deficit spending is, consider the decomposition of spending into its major components:

“Discretionary” spending includes such items as the military; net interest on the debt will be higher than defense spending going forward. Although not shown directly in the chart above, the CBO report has tables showing that in 2024, military spending will be $850 billion, while interest on the debt is $870 billion, and that excess is projected to grow over time.

Conclusion

The US federal government has plunged itself into a deep fiscal hole. We can expect a combination of tax hikes, entitlement cuts, and backdoor money printing from the US Treasury and Federal Reserve. Investors and workers alike should prepare for what is coming.

NOTE: This article was released 24 hours earlier on the Infinite Banking (IB) 3.0 - The Future of Finance Group

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

Linkedin: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

Comments