Peter Schiff vs. Raoul Pal

In late July there was an interesting discussion/debate between investor gurus Peter Schiff and Raoul Pal. They touched on several issues that I have written about in this forum, so I thought it worthwhile highlighting some of their observations. It’s also a useful conversation because their views are so similar in many respects, that on the areas where they disagree—particularly on Bitcoin and the fate of the stock market—the hard-money investor can refine his or her own position with more nuance.

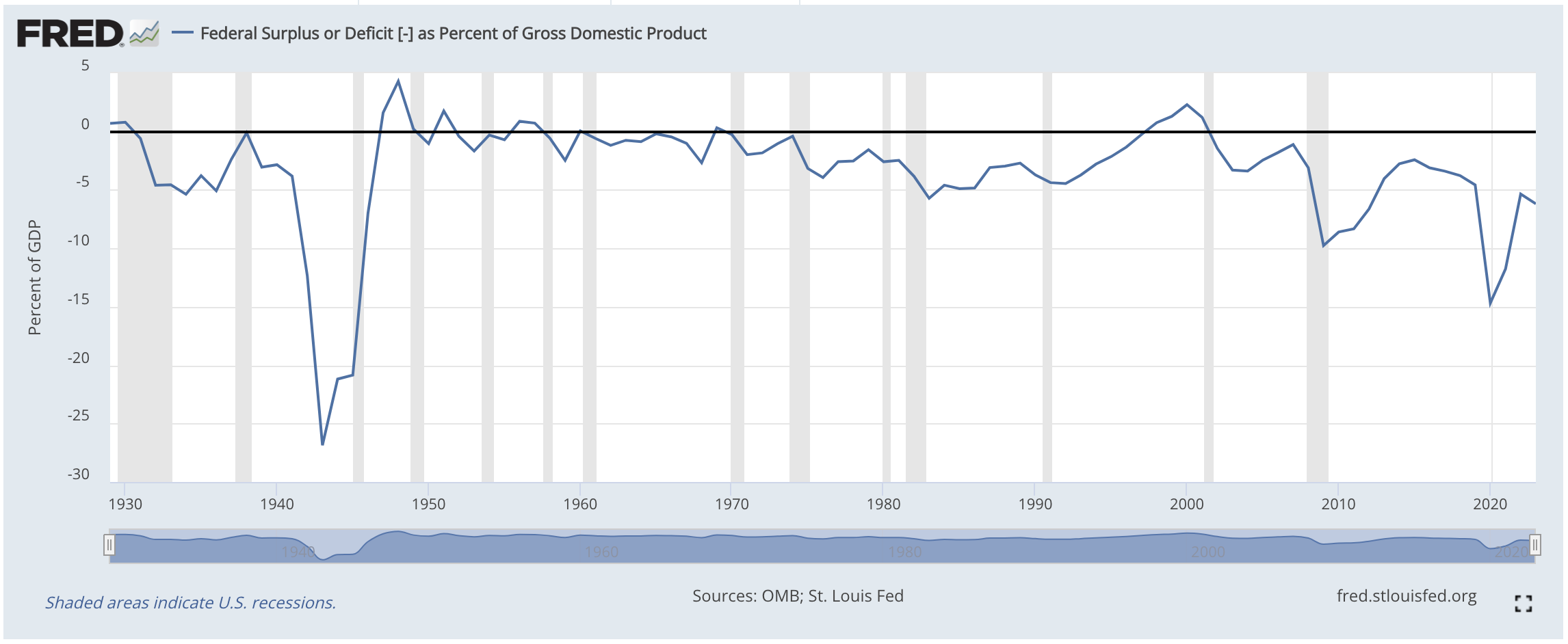

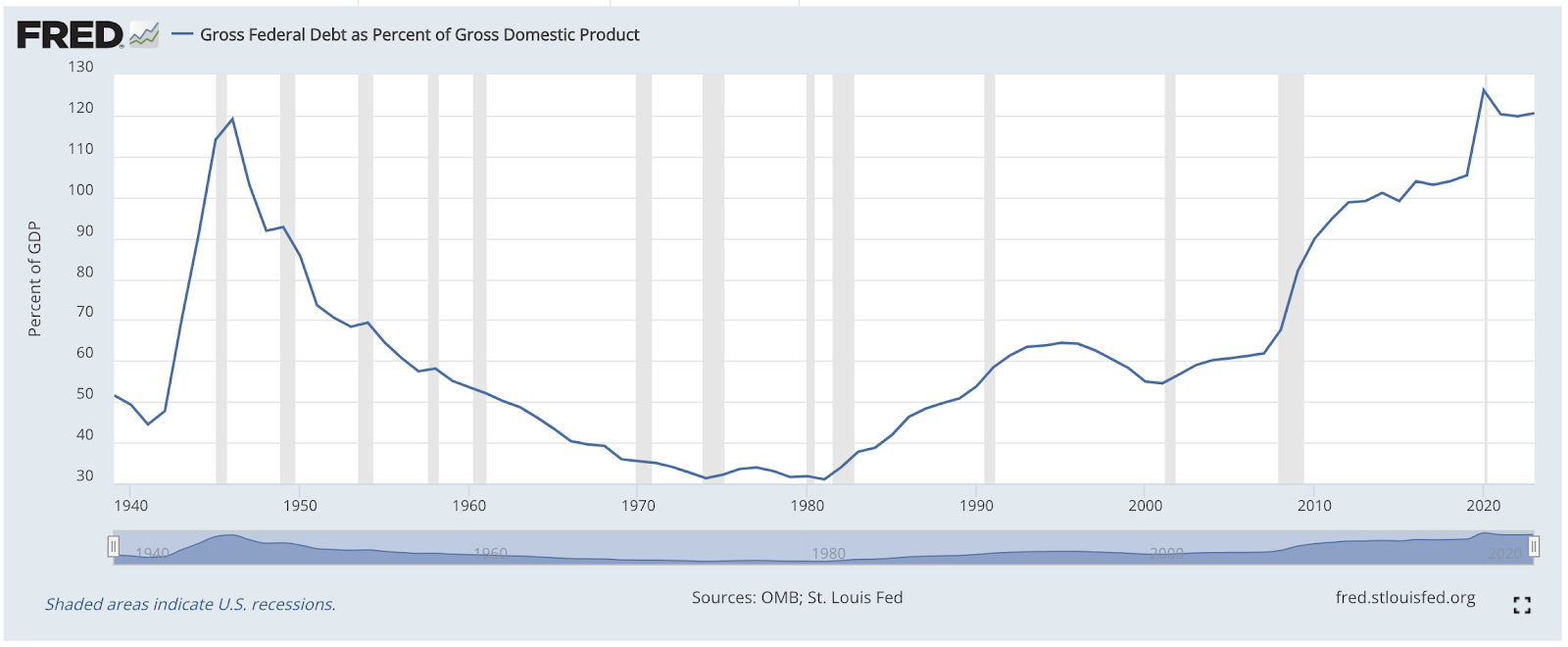

🡺 The US fiscal position now, versus World War II: Peter made a great point during the discussion, explaining how the current US debt-to-GDP ratio is far more burdensome than was the case immediately after World War II. Back then, the debt had ballooned because of the one-off expense of the war. Immediately following the war, the US actually ran sizable budget surpluses, and then kept the deficit relatively low in order for the economy to outgrow the nominal debt:

As the chart above shows, in 1947 and 1948 there were quite large surpluses (as a share of the economy), and indeed up through 1970 the budget deficit was never particularly large. However, except for a brief string of surpluses during the Clinton years, the US fiscal position has deteriorated ever since Richard Nixon closed the gold window in 1971.

Although it’s not shown on this chart, elsewhere I have produced the CBO’s long-term forecasts, which show that there is no end in sight. Again, when the debt spiked due to World War II, the US government could simply slash spending and return to fiscal sustainability after the crisis had passed. But our current budget has the long-term problems of “unfunded liabilities” (due to an aging population) built into it. The US Treasury is currently spending more on interest payments than on the military. There is no way to simply grow out of the current debt load, as the US did in the 1950s and 1960s:

🡺 Another theme in the discussion were the participants’ differing views on being a permabear. Peter (as is his wont) was still adamant that Bitcoin has no intrinsic value. I understand his position, but I wonder at what point will he admit that it is an asset that’s around for the long haul? Suppose Bitcoin trades for $200,000 in the year 2030. Will that be a long enough of a track record to stop thinking it has no place to go but $0? Along similar lines, Raoul cautioned Peter and the viewers to occasionally step back and make sure their paradigm really did explain the facts. In particular, Raoul (if I understood him) seemed to lament that he had correctly “called” several crises over the years, but his investment performance was not rewarded correspondingly because of so much missed opportunity during bull markets.

🡺 Finally, I enjoyed the discussion of AI. Peter had a more conservative approach, saying it would definitely boost efficiencies but he didn’t seem to think it was paradigm-shifting. In contrast, Raoul thought that investors should be reluctant to make long-term forecasts about asset markets at this point, since the world of the near-future might be so incredibly different as AI makes conventional productivity measures explode upward.

All in all, it was a very provocative yet friendly discussion, which I encourage our readers to view.

NOTE: This article was released 24 hours earlier on the IBC Infinite Banking Users Group on Facebook.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

Linkedin: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

Comments