Should the US Government Accumulate a Bitcoin Reserve?

In conjunction with remarks delivered at the Nashville Bitcoin conference, Senator Cynthia Lummis (R-WY) in late July introduced her BITCOIN Act, which would instruct Federal Reserve / Treasury officials to rearrange their asset holdings to begin accumulating a strategic reserve of 1 million bitcoins (which would be about 4.8 percent of the long-run ceiling of 21 million bitcoins that will be mined). Lummis and other supporters argue that this move would ensure that the United States doesn’t fall behind in the emerging new global financial paradigm. In this post I’ll outline some of my reactions to the proposal, from my perspective as an Austrian economist skeptical of government intervention into the economy.

🡺 In the abstract, I would like to see the US authorities get out of the money and banking sectors altogether. Just as I don’t want US officials taking a stand on the ideal mix of condiments to put on a burger, or how many gallons a toilet should use per flush, I don’t want them steering choices of currencies. By reducing its footprint in the financial markets, a scaled-back (or better yet, abolition) of the Fed would give private American individuals and companies more freedom to acquire Bitcoin, gold, or Australian farmland for that matter. It’s a sad commentary on our current framework that senators have such an impact on Americans’ financial future.

🡺 Many cynical fans of hard money have for decades wondered whether government officials were short-selling gold and silver behind the scenes, in order to manipulate markets and protect the reputation of the USD. Even if Bitcoin fans trust Senator Lummis and Jay Powell to have nothing but the general welfare in mind, that wouldn’t stop future US officials from using an enormous Bitcoin reserve in ways that maxis wouldn’t appreciate.

🡺 Notwithstanding my above complaints, I can also be realistic and acknowledge that we are not going to “End the Fed!” next Thursday. So if the question is, “Given the broad outlines of our current system, should Fed/Treasury officials stockpile Bitcoin?” then my answer becomes, “Yes, but modestly.”

The reason for moderation is that Bitcoin is still incredibly volatile, relative to other assets. Even if most investors (except for notable critics such as Peter Schiff) are pretty sure that Bitcoin will appreciate more than stocks—and let alone Treasury securities—over (say) the next ten years, they also think that Bitcoin’s market price measured in government fiat currencies will fluctuate much more violently over that period as well. (After all, this has to be true, otherwise Bitcoin would already be bid up to a much higher spot price, reflecting its expected long-run value discounted by a much lower factor.)

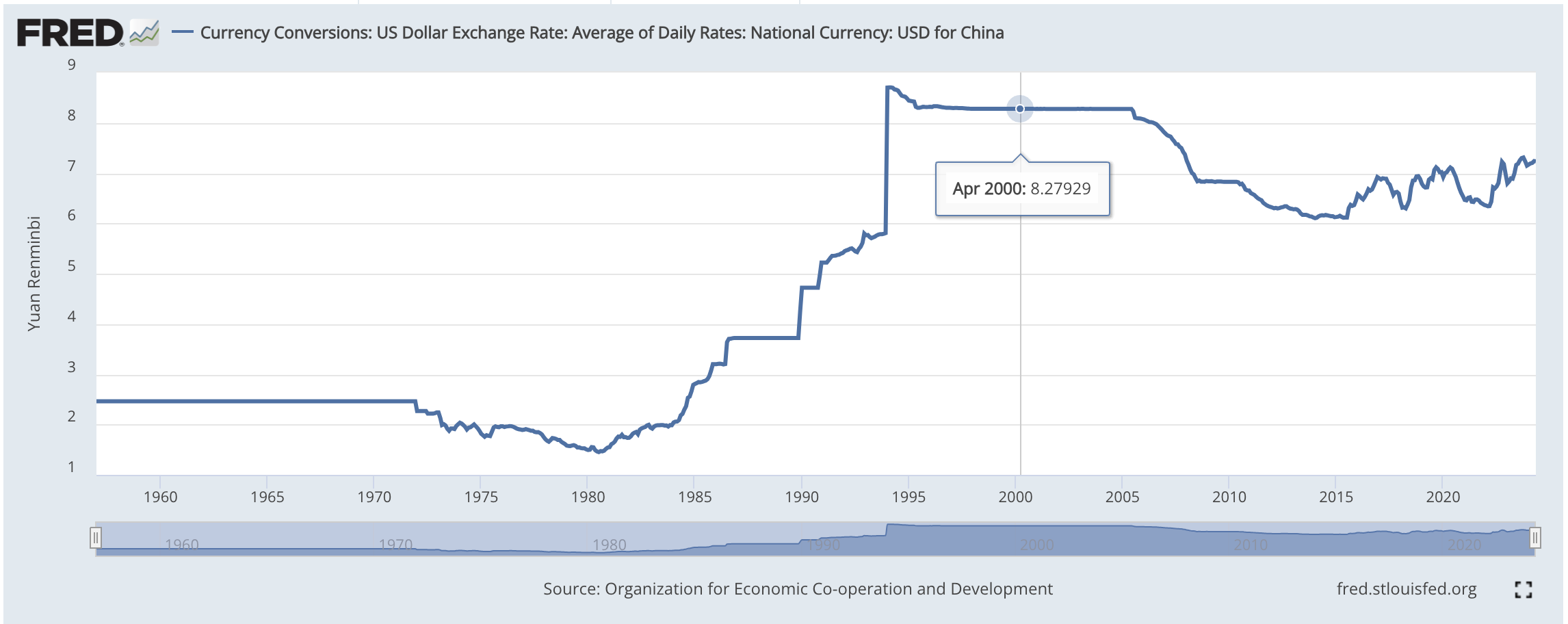

🡺 It is worth reviewing what the point of having reserve assets is. Sometimes, for example, a government/central bank wants to peg its currency to another. For example, in the late 1990s through mid-2005 the Chinese authorities maintained a tight peg of the yuan to the USD:

Now how could the Chinese authorities credibly maintain this peg? They accumulated massive holdings of US Treasuries, such that if the yuan ever weakened, they had a ready supply of dollars to enter the forex markets and push the yuan back up to the desired level. (There was no problem of the Chinese being able to create more yuan if the market exchange rate drifted the other way and the yuan became too strong for the peg.)

On these grounds, we can see why governments/central banks might want to hold safe bonds denominated in other major currencies (USD, euro, yen, etc.). But absent an official policy to peg the government currency to Bitcoin (effectively adopting a Bitcoin standard, just like countries used to be on a gold standard), this wouldn’t provide a rationale for large holdings of Bitcoin.

🡺 In the end, the justification for US officials accumulating a Bitcoin reserve would be the same as for a private institutional portfolio manager with large USD liability. For example, USD stablecoin-issuer Tether as of this writing holds more than 75,000 bitcoins (market value exceeding $4 billion). This is an entirely sensible stance, because these holdings merely supplement their enormous holdings of short-term USD-denominated fixed-income assets.

In a similar manner, it can make sense for central banks to hold stockpiles of gold (and now Bitcoin) as hedges against the debasement of their government fiat currencies. Even though a modern central bank wouldn’t legally be forced to shut its down for “going bankrupt,” it could still lose traction if it becomes insolvent and can no longer sell off assets to suck out the money that they had earlier pumped into the system. By having gold, Bitcoin, and other inflation hedges, these central banks can protect themselves from conventional currency crashes, just like other institutional portfolio managers.

But in closing, I want to stress that the rationale for such hedging is different. The point of Fed officials stockpiling bitcoins isn’t that it’s “a good investment.” To repeat, we don’t want Fed officials speculating with the public’s money. (Even if you think it’s a no-brainer with respect to Bitcoin, it’s still an awful precedent.) Rather, the only sensible justification would be to maintain the central bank’s ability to manage price inflation and other duties in an evolving financial arena.

NOTE: This article was released 24 hours earlier on the IBC Infinite Banking Users Group on Facebook.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

Linkedin: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

Comments