Should We Blame/Congratulate the Fed for Inflation Rates?

Now that economists have largely come to believe that the US is in store for a “soft landing” — a view I have criticized earlier — they are now arguing about whether the Fed should be credited with putting the inflation genie back in the bottle. Those who opposed the Fed’s aggressive rate hikes all along are now arguing that this abrupt change in the central bank’s stance couldn’t possibly explain what happened because monetary policy only works after “long and variable lags” (to use Milton Friedman’s famous phrasing).

In this post, I’ll show that the doubters are standing on thin ice. The empirical evidence sure looks like the Fed’s policies had much to do with the surge, and then retreat, of price inflation after Covid. Moreover, economists have long argued that expectations can play a role in transmitting future Fed policy into tangible effects in the present.

For good or ill, America’s recent bout of decades-high price inflation can be largely laid at the feet of the Fed.

The Doubters

To give two specific examples of skeptics, we will quote from Alan Blinder and James Galbraith, both well-known economists. Former Fed vice chair Blinder wrote in the Wall Street Journal back in January:

Was…the stunning drop in inflation in 2022 due to the Fed’s interest-rate policy? Driving inflation down was certainly the central bank’s intent. But it defies credulity to think that interest-rate hikes that started only in March [2022] could have cut inflation appreciably by July [2022]. There is an argument that monetary policy works faster now than it used to — but not that fast. [Bold added.]

And just last week, Galbraith made basically the same point at Project Syndicate (see ungated version without hyperlinks here):

Back in 2021 and early 2022, a posse of prominent economists, including Lawrence H. Summers, Jason Furman, and Kenneth Rogoff, all of Harvard, criticised the Biden administration’s fiscal and investment programme, and pressured the US Federal Reserve to raise interest rates. Their argument was that inflation, fueled by federal spending, would prove “persistent”, requiring a sustained shift to austerity. Unemployment, sadly, would have to rise to at least 6.5 per cent for several years, according to one study touted by Furman.

…

But the macroeconomic situation today has confounded both positions. Contrary to those advocating austerity, inflation peaked on its own in mid-2022 (owing partly to sales from the US Strategic Petroleum Reserve). There was no persistence, no surge from the 2021 fiscal stimulus, and no wage-driven inflation from low unemployment. The models and historical precedents that the Harvard trio had relied on clearly no longer apply (if they ever did).

…

These happy circumstances have led some observers to congratulate Powell and the Fed on achieving a “soft landing”. But crediting the Fed is magical thinking. There is no way, under any theory or precedent, that rate hikes beginning in [March] 2022 could have knocked back inflation by July of the same year. Whatever its consequences down the road, the Fed’s policy tightening has been irrelevant to the inflation slowdown so far. [Bold added.]

In summary, both Blinder and Galbraith confidently claim that the Fed’s change in policy in early 2022 couldn’t be responsible for the turnaround in consumer price inflation.

Evidence that the Fed Affected Inflation Rates

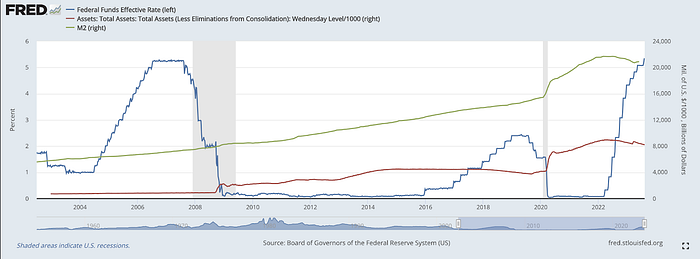

In the first chart below, I plot three things:

- The blue line is the federal funds rate, which is the overnight rate banks charge each other for overnight loans of reserves.

- The red line is the total assets held by the Fed.

- The green line is the M2 monetary aggregate, effectively “money held by the public,” not just in checking accounts but also in money market mutual funds.

As the chart above shows, going into the Covid lockdown/recession in early 2020 (indicated by the thin gray bar), the Fed rapidly dropped short-term interest rates (blue line) down to basically 0%. At the same time, the Fed rapidly expanded its balance sheet (red line), increasing its holdings by more than 60 percent in two months. There was a similar pattern with M2 (green line), which zoomed upward during the Covid recession and continued rising rapidly.

Yet as the chart also indicates, this incredibly loose monetary policy flipped on a dime two years later in March 2022. The Fed began rapidly hiking interest rates, and both the Fed’s balance sheet and the M2 measure of money peaked and started falling.

So now that we’ve seen the unambiguous sense in which the Fed adopted a “loose” or “easy” policy when the Covid panic struck and then quickly reversed course two years later, what happened with the timing of consumer price inflation? We show that in the following two charts.

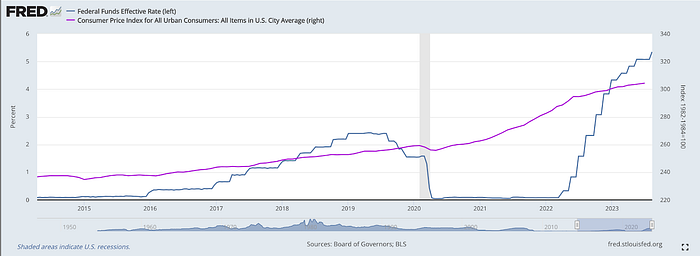

First, consider the level of the Consumer Price Index (CPI). In the chart below, I’ve retained only the federal funds rate (still a blue line) to keep our bearings:

The above chart shows the CPI (purple line) going into the Covid recession (gray bar) at first drops, but then by early 2021, it begins rapidly ascending, well above its trend growth rate.

However, a “kink” in the purple line occurs in June 2022, when the trajectory suddenly becomes a much more gradual ascent.

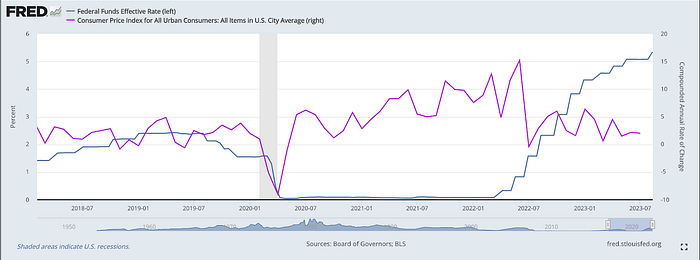

Instead of looking at the level of the CPI, for another perspective, we can look at the monthly percentage change(expressed at an annualized rate) of the CPI:

In this last chart above, we see that the monthly percentage change in CPI first dropped to –9 percent in April 2020 but then began rising rapidly, hitting a peak above 15 percent in June 2022. But then it quickly returned to more historically normal levels and bounced around in a more typical range.

The Role of Expectations

As the above charts demonstrate, it seems as if the Fed’s policies can explain the rapid surge and collapse of consumer price inflation rates. After all, when the Fed opened up the monetary spigot and slashed rates, CPI zoomed up, and then as the Fed did the opposite, CPI growth quickly slowed. What’s the puzzle here?

To review what the doubters — such as Blinder and Galbraith — argue, it is implausible that the Fed’s hikes could have had such an immediate impact. I can strengthen their case by pointing out that when the Fed initially injected money and slashed rates, CPI didn’t immediately surge; it first collapsed and took several months to get going. So why would the Fed’s hikes have a shorter turnaround time?

One obvious answer here is that the Fed was communicating to the markets throughout late 2021 that it was at some point going to reverse its “accommodative” monetary policy to quell the rising CPI inflation that just kept coming in worse and worse each passing month. For example, here is an excerpt from the minutes of the December 14–15, 2021, Federal Open Market Committee meeting (which were made public on January 5, 2022):

Desk’s surveys of primary dealers and market participants broadly projected that the Committee would quicken the pace of reduction in the Federal Reserve’s net purchases of Treasury securities and agency mortgage-backed securities (MBS), and the median respondent projected net asset purchases to end in March 2022. The median respondent’s projected timing for the first increase in the target range for the federal funds rate also moved earlier from the first quarter of 2023 to June 2022.

…

Many participants judged that the appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode.

…

Market participants’ views on the expected path for the federal funds rate — as implied by a straight read of overnight index swap quotes — suggested that they had pulled forward expected rate increases more into 2022 and 2023 compared with the timing they anticipated at the time of the previous FOMC meeting. The potential for a less accommodative policy stance over the next few years contributed to a notable rise in two- and five-year Treasury yields. [Bold added.]

In the excerpts above, I haven’t quoted what the Fed officials thought about their future policy. Instead, in the excerpts above, the Fed officials are discussing their reading of market expectations as the sections in bold make clear, as of December 2021, the middle-of-the-road forecast in the financial markets was that the Fed would stop adding to its balance sheet by the coming March and that it would begin hiking rates in June. Moreover, the markets predicted that the Fed’s removal of liquidity would be faster in this cycle than it had been after the various rounds of QE following the financial crisis.

Based on earlier Fed messaging, by December 2021, the financial markets correctly anticipated the Fed’s rapid “turnaround” in policy that would begin in March 2022. Of course, there are always millions of moving parts in the real-world economy, and various other factors — such as supply chain bottlenecks, the war in Ukraine, etc. — each contributed to the outcome. But prima facie, there is no reason to doubt what is staring us in the face: The Fed’s slamming on the brakes in March 2022 — which markets had seen coming for at least four months — certainly had a lot to do with the disinflation that set in by July 2022.

For better or worse, the varying fortunes of the US dollar and the broader economy can be laid at the feet of the Fed.

NOTE: This article was released 24 hours earlier on the IBC Infinite Banking Users Group on Facebook.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Comments