The Conservative Battle Over the Big, Beautiful Bill

The conservative/libertarian coalition on the right wing of American politics has been steadily eroding since Donald Trump’s reelection. As I write this post, there is a raging battle over foreign policy (due to the Israeli strike on Iran), but this occurs amidst the feud over fiscal policy.

Specifically, Trump and his allies have been harshly criticizing Senator Rand Paul and Rep. Thomas Massie for their opposition to the “Big Beautiful Bill” (BBB). The libertarian Paul and Massie claim that the BBB is far too tepid in its budget cuts, squandering the last chance Republicans will have to salvage the Treasury’s sinking position. On the other hand, Trump & Co. argue that this is as good as it gets, and it is imperative to keep in face the original Trump tax cuts that are scheduled to expire absent new legislation.

In this post, I’ll explain both perspectives, because they are each “right” insofar as they go. My point isn’t to take sides, but just to clarify for the reader how the numbers all fit together that you may hear being thrown about in the online debates.

The CBO Score: Massive Spending and Tax Cuts in the BBB

Here is an example of the pro-BBB camp: Stephen Miller touts the virtues of the bill, and can’t understand why conservatives aren’t applauding it:

When I saw that tweet, I looked it up myself. Specifically, I checked what the Congressional Budget Office (CBO) had to say. And they confirmed Miller’s claims, with their June 4 estimate reporting that over a ten-year horizon (which is standard in these scoring exercises), the BBB would reduce federal outlays by $1.3 trillion, but it would reduce revenues by $3.7 trillion, thus increasing the deficit (if we ignore extra interest costs) by $2.4 trillion.

At this point, note that the CBO analysis confirms (a) what Stephen Miller said but also (b) what the “Community Notes” brought up. And so, there’s no contradiction here. Yes, the BBB increases the deficit, but that’s because it’s letting taxpayers keep more of their money. When Elon Musk shares videos of Milton Friedman arguing that ultimately it’s government spending that’s the true “burden of government,” it actually underscores Miller’s cheerleading.

Ironically, on this specific point even Thomas Massie (whom I consider the best member of Congress) fumbled the ball. Consider the following exchange:

Here, rather than point to $300 billion of pork barrel spending that could easily be cut, instead Massie complains about tax cuts in the BBB—and then suggests that they are dubious because they’re going to rich people. As a general rule, it’s egalitarian leftists who complain about “tax giveaways to the wealthy,” not libertarian hardliners.

The CBO Analysis Is Relative to the (Outrageous) Baseline

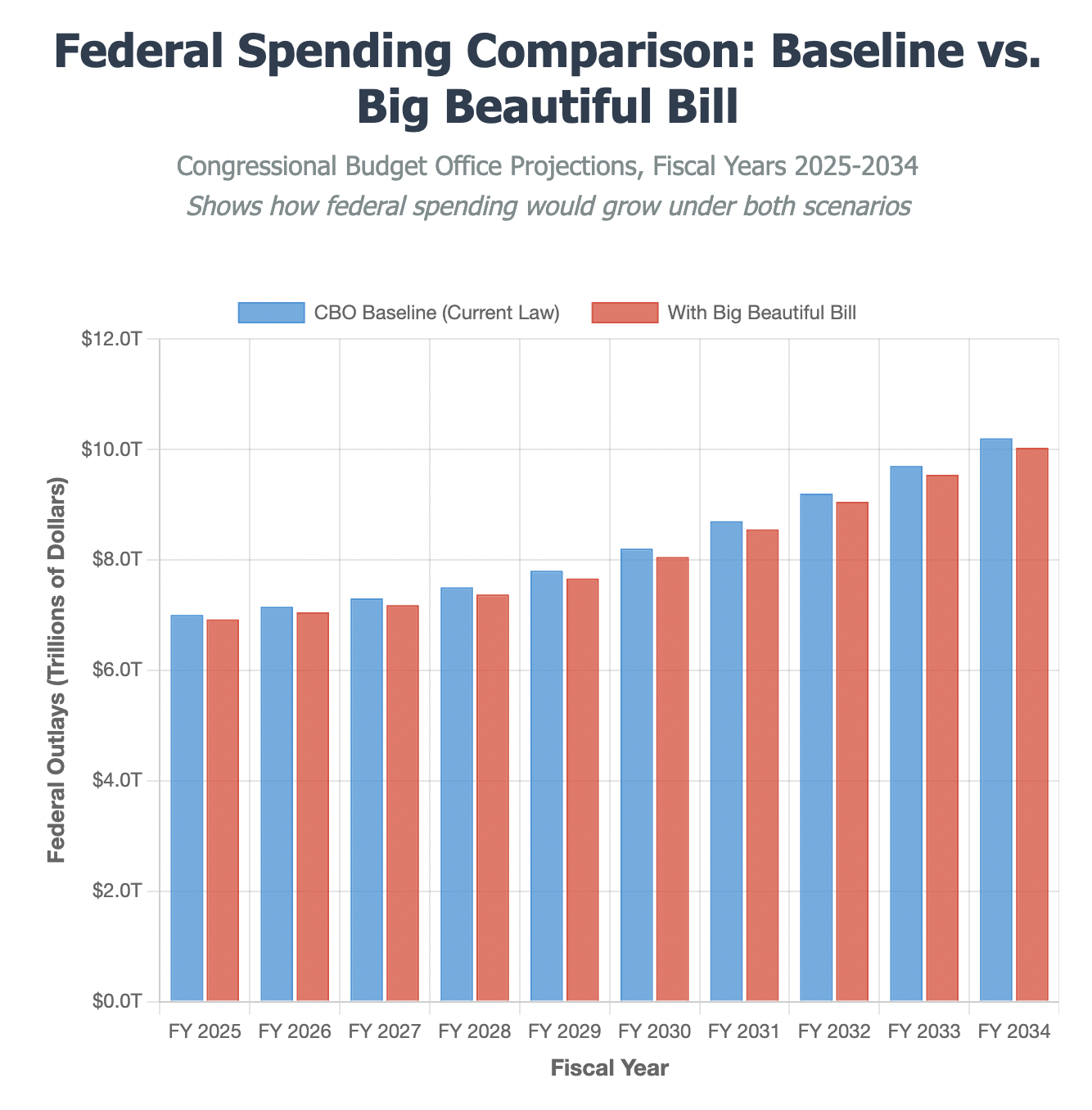

To be clear, I agree with Massie (and Rand Paul) that the BBB is too little, too late, when it comes to the dismal fiscal position of the US. Even though it does indeed cut $1.3 trillion over ten years, that is small potatoes when we consider that the federal budget’s baseline growth has it rising from $7.0 trillion in fiscal year 2025 up to $10.3 trillion in FY 2034 (see Table B-2).

The following chart shows the trivial impact the BBB’s cuts have, relative to the growth that was originally baked into the cake:

This chart largely speaks for itself, and I think succinctly summarizes the perspective of the two camps on the BBB. The fans are right when they say it slashes an enormous amount of spending over 10 years, but the critics are right when they say it’s not nearly enough, because these “cuts” are relative to a massively expanding baseline.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

Twitter: @infineogroup, @BobMurphyEcon

Linkedin: infineo group, Robert Murphy

Youtube: infineo group

To learn more about infineo, please visit the infineo website

Comments