Comparing Whole Life to “Buy Term & Invest the Difference” Part 2 of 2

In my prior post, I explained that in this two-part series, I was going to address the popular match-up between Whole Life insurance on the one hand, and “Buy Term & Invest the Difference” on the other. My point wasn’t to pick a winner and loser, but to show how I, as an economist, would go about trying to evenly assess the pros and cons of either strategy.

In that first post, I gave the broader context of the debate, and explained the particulars of each strategy. Specifically, Strategy 1 involves a 25-year-old nonsmoking male putting about $15,000 a year into a Whole Life policy that delivers a starting death benefit of (a little more) than $1 million and grows over time. After thirty years, the man stops contributing money out-of-pocket and lets the dividends generated by the policy pay the contractual premium.

Strategy 2 involves the same hypothetical man, buying a 30-year term policy with a face death benefit of $1 million from the same company, and putting the difference (because the annual premium is so much lower) into a “side fund” that earns 3.5 percent in after-tax returns.

For the fuller setup and discussion of these assumptions, please refer back to that first post. Now we proceed to the cage match.

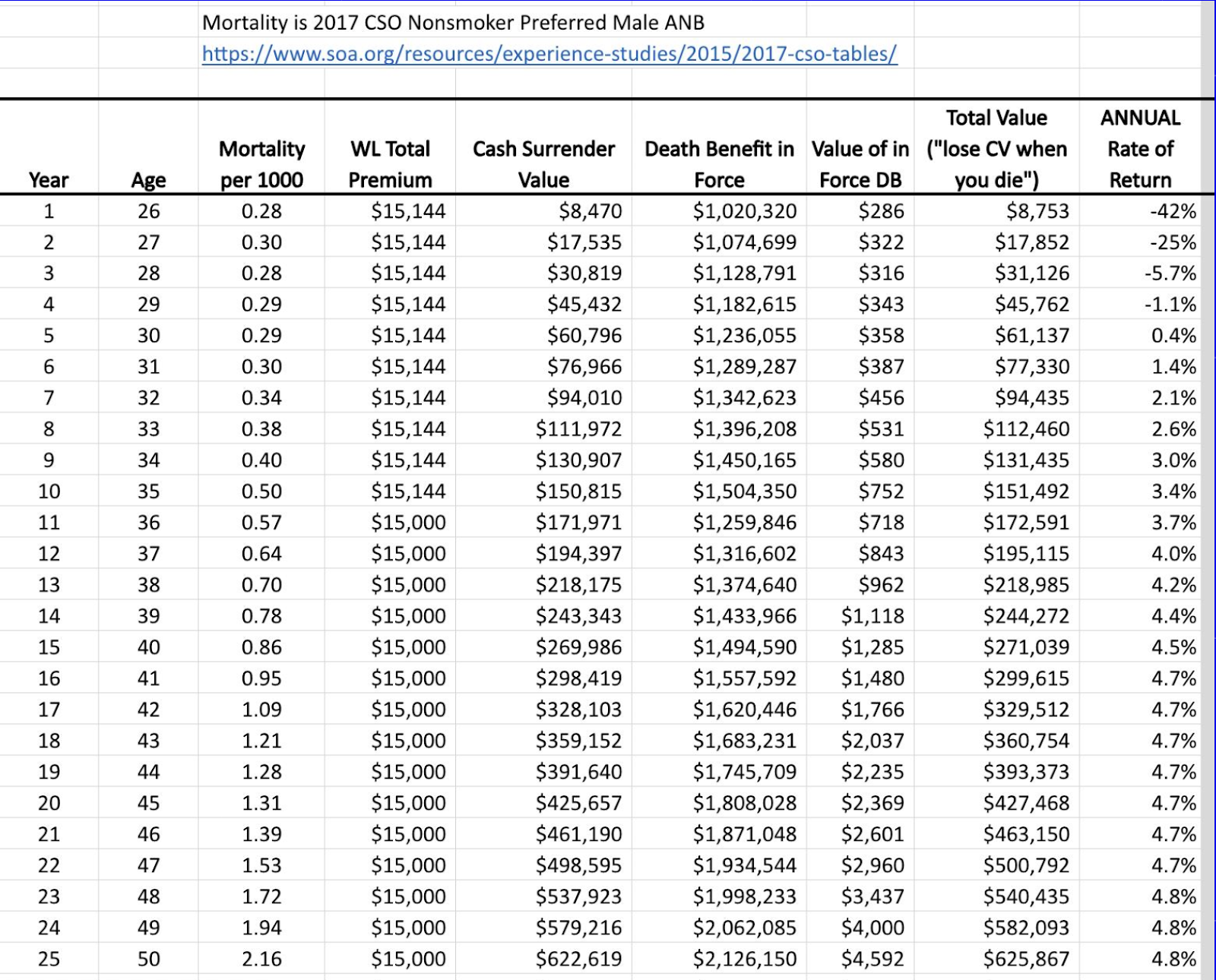

Results of Strategy 1 (Whole Life)

I took the data from the Whole Life illustration (which I gave a screenshot of in Part 1) and put it into my trusty Excel spreadsheet, along with the 2017 mortality data used by life carriers:

The column marked “Value of in Force [Death Benefit]” takes the mortality rate for that age and multiplies by the death benefit in force at that time. The idea is that having in-force death benefit coverage is certainly valuable, but it’s not as valuable as having that same face value of death benefit in the bank. You have to adjust for the probability of actually getting the money that year. So as a first approximation, I just took the “expected” value (even though technically economists would normally worry about risk aversion etc.).

For the Total Value column, I want to be clear that I have taken into account the fact that when you die with a Whole Life policy, your beneficiaries only get the death benefit, not the Cash Surrender Value as well. (This explains why the Total Value column is a little bit smaller each year, compared to the raw sum of the Cash Surrender Value and the in-force death benefit valuation. There would be a slight bit of “double counting” involved if you naively added those two numbers together for the total.)

Finally, the ANNUAL rate of return—which is to be distinguished from the cumulative annualized rate of return, another popular metric—simply looks at the percentage growth from last year’s total value to this year’s, taking account of any premium payment.

As we can see, the rate of return is atrocious early on, reflecting the upfront loads characteristic of Whole Life policies. But by year 12 the internal growth rate has broken 4 percent, and keep in mind this is effectively after-tax return because, handled correctly, the owner of the policy need never face tax liability on this growth.

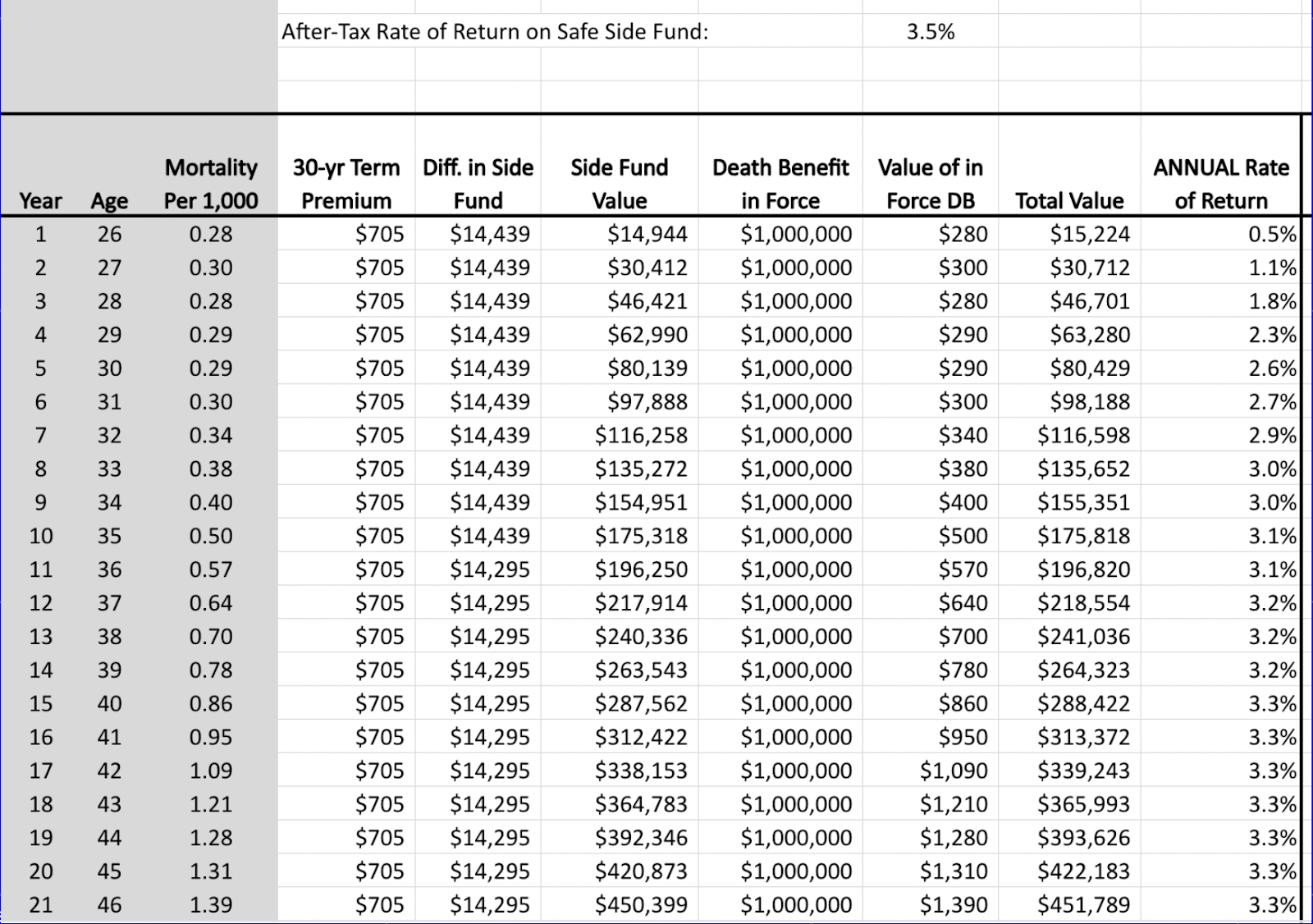

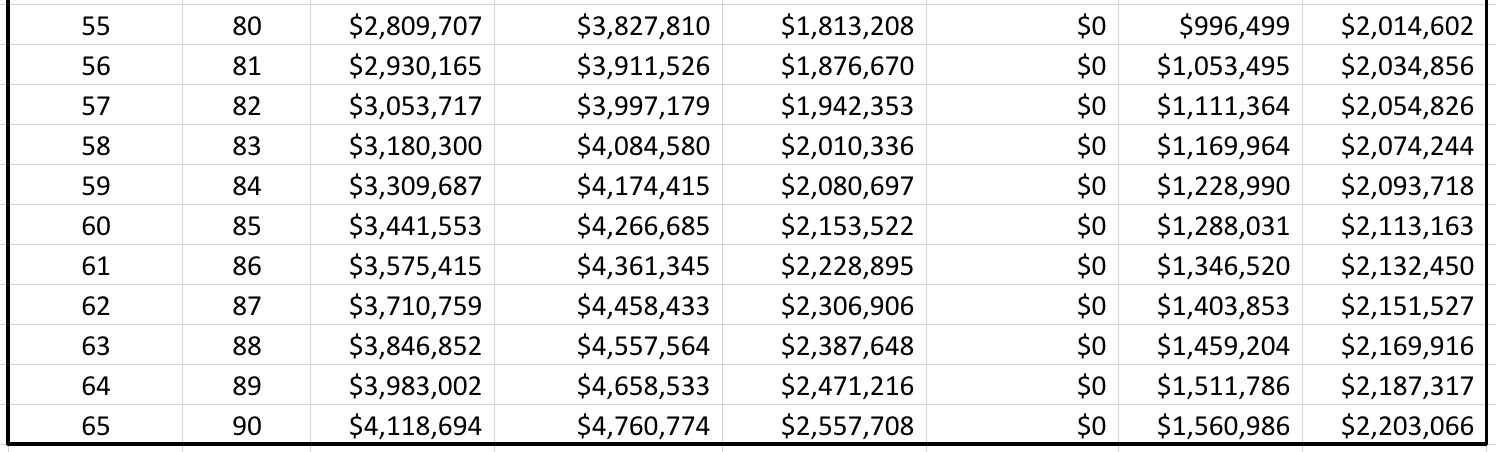

Results of Strategy 2 (Buy Term & Invest the Difference)

We now present a similar analysis of Strategy 2:

...

Just a few additional notes on the above results: Notice that the death benefit in Strategy 2 is a constant $1 million, whereas the DB constantly grew in Strategy 1 (as 60 percent of the premium, plus any dividends in the first 30 years, went to buying more paid-up life insurance).

Notice that in this case, the Total Value column is the simple sum of the Side Fund and the mathematical expectation of the death benefit coverage. That’s because—as Dave Ramsey stresses—when you die with a term policy, your estate gets the death benefit plus the “side fund.”

Also, notice that the internal rates of return are pretty paltry even for Buy Term & Invest the Difference in the early years. Even though the side fund chugs along at 3.5 percent, the total portfolio grows at a slower rate, because there’s a “drag” from the term policy coverage. That drag is especially pronounced in the early years, when the young man is significantly “overpaying” $705 for a term policy when the actual pure cost of insuring him in those years is much lower (as we documented in Part 1 of this series).

Finally, notice the blip downward in the rate of return in Year 31 (Age 56), when the term policy falls away. Dave Ramsey doesn’t take this type of thing into account, but there is a definite hit to one’s overall financial position when a large insurance policy expires. That consideration doesn’t settle the debate, but it can’t be ignored.

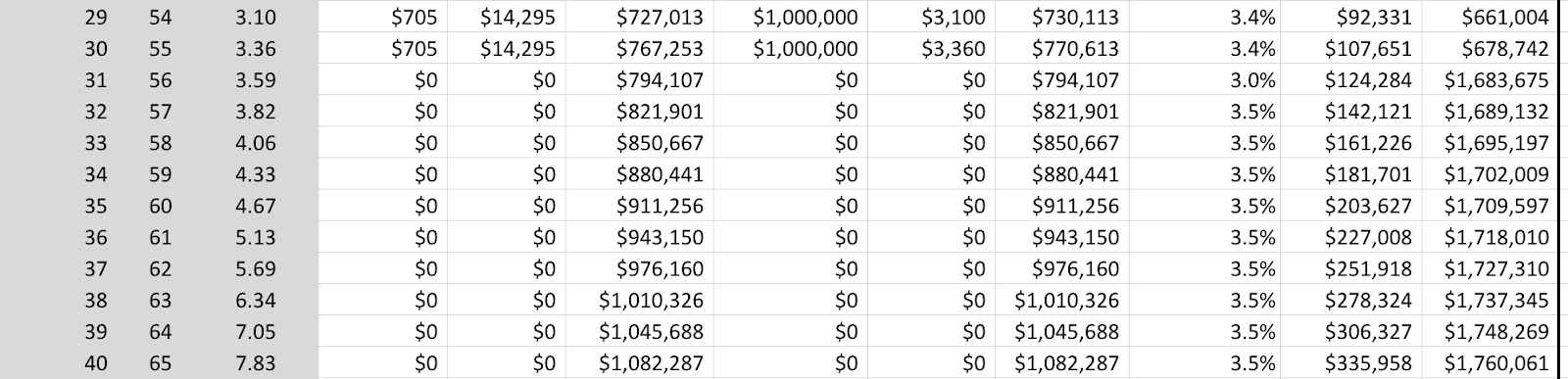

Head to Head

For ease of comparison, I’ve condensed the above information into a smaller table, along with the financial scorecard depending on whether the person stays alive or dies in a given year:

...

Some discussion regarding these final tables: First, no matter when our hypothetical man dies, he will have more total wealth if he sticks to the Whole Strategy, than if he implements Buy Term & Invest the Difference (BTID). That is, whether we look at Year 1 (Age 26), Year 20 (Age 45), or Year 65 (Age 90), the death benefit offered by the Whole Life policy is higher than the side fund (added to the term policy if still in force).

Second, the red numbers show that if the man stays alive, then Strategy 2 is more advantageous for the first 19 years. So in a scenario where the man really needed cash, and could no longer afford to keep paying his Whole Life premium, he might regret having adopted Strategy 1. In other words, if the man needs to bail out within the first 19 years, his exit option from Strategy 2 is more lucrative. Yet even this advantage is fleeting, because by Year 20 (Age 45) onward, whether the man is alive or dead, he has wealth in Strategy 1.

At this point, let me address an obvious objection that the proponent of BTID might raise: “Sure Murphy,” she could say, “I get your arguments from Part 1 in this series, where you said why you thought a fair apples-to-apples comparison would only have the Side Fund yielding a consistent long-run after-tax return of 3.5 percent. But surely by Year 10, when the Side Fund has exceeded $175,000, our hypothetical man can let that roll over at the same 3.5 percent, and start putting his $14,000-and-change into a more aggressive mutual fund, which will grow a lot faster than 3.5 percent. So he still has a super safe fund of liquid assets, but supplemented with a second side fund that enjoys stock market returns. If he lives to life expectancy, that combo will surely beat your sleepy Whole Life policy.”

This is a perfectly understandable reaction. But again, we need to be consistent in our treatment. Partway through Year 11, the Whole Life strategy will have a Cash Surrender Value exceeding $175,000. So if the man in Strategy 2 is allowed to start investing his funds more aggressively after having built up a nice safety fund, then the man in Strategy 1 is allowed to borrow against his Whole Life policy and invest in the same asset. True, the policy loan interest rate (currently in the 5 percent-and-change range) will be higher than the internal growth rate of the Whole Life policy, but the gap and hence “drag” will be modest, meaning the man can almost enjoy the same returns on the aggressive asset if he so chooses.

This is an important point so I want to emphasize it: The community of financial professionals touting the advantages of permanent life insurance and its “living benefits” are not merely saying everyone should “invest in life insurance” the way one might invest in gold or real estate. Rather, they are saying that customized Whole Life policies are a great “headquarters” for one’s money, to be deployed when an opportunity arises.

Unlike tax-qualified plans such as a 401(k) or Roth IRA, when it comes to a Whole Life policy your money isn’t in prison. You can use it (via a policy loan) to buy other assets that you think will perform well. But especially if you may be engaged in short- to medium-run bursts, where your portfolio of assets turns over periodically, then a Whole Life policy (or suite of such policies) is an excellent foundation. It eventually grows without tax liability (if handled properly) at a respectable rate in the high 4s or even low-5s percent, the principal is incredibly safe, and is immune from both market and even interest rate risk.

As this two-part series has shown, there are always tradeoffs in financial markets. There are scenarios where one would definitely regret having heavily funded a Whole Life policy. But in general it is extremely robust, performing as the Swiss Army knife of assets.

NOTE: This article was released 24 hours earlier on the IBC Infinite Banking Users Group on Facebook.

Dr. Robert P. Murphy is the Chief Economist at infineo, bridging together Whole Life insurance policies and digital blockchain-based issuance.

.png?width=520&height=294&name=New%20Article%20Thumbnails%20(34).png)

.png?width=520&height=294&name=New%20Article%20Thumbnails%20(20).png)

Comments